MPT Part 2: Several Securities: Risk and Expected Return

Published:

Modelling and visualisation on some of the financial engineering theorems using Jupyter Notebook. The mathematics of the theorems follow the book: Capinski, M. and Zastawniak, T. (2011). Mathematics for Finance. An Introduction to Financial Engineering (Second Edition).

Check the Jupyter Notebook in my Github repository Python-for-mathematical-finance , or run the code in Google Colab MPT Part 2 - Several Securities: Risk and Expected Return.

Table of Contents

- 1 Several Securities: Risk and Expected Return

Several Securities: Risk and Expected Return

import numpy as np

import pandas as pd

import pandas_datareader as pdr

import seaborn as sns

import matplotlib.pyplot as plt

import matplotlib.colors as mcolors

import random

from tqdm.notebook import tqdm

tqdm.pandas()

Porfolio risk and expected return

Theoretical development

For the portfolio constructed by $n$ different securities, the weight for security $i$ is:

\[\begin{equation*} w_i = \frac{x_iS_i(0)}{V(0)}, i = 1, 2, ..., n. \end{equation*}\]Here $x_i$ is the amount of security $i$ in the portfolio, $S_i(0)$ is the initial price of security $i$, $V(0)$ is the initial amount of investment in the portfolio. The weight can be expressed as:

\[\begin{equation*} \mathrm{w} = \begin{bmatrix} w_1 & w_2 & ... & w_n \end{bmatrix}. \end{equation*}\]The sum of weights equal zero, as:

\[\begin{equation} 1 = \mathrm{w}\mathrm{u}^T, \mathrm{u} = \begin{bmatrix} 1 & 1 & ... & 1 \end{bmatrix}. \end{equation}\]The stock returns in the feasible portfolio are $K_1,…,K_n$, and the expected returns are $\mu_i = E(K_i)$, $i=1,2,…n$:

\[\begin{equation*} \mathrm{m}= \begin{bmatrix} \mu_1 & \mu_2 & ... & \mu_n \end{bmatrix}. \end{equation*}\]The covariance between two stock returns is expressed as $c_{ij} = Cov(K_i,K_j)$, or in $n\times n$ covariance matrix:

\[\begin{equation*} \mathrm{C} = \begin{bmatrix} c_{11}&c_{12}&\cdots&c_{1n}\\ c_{21}&c_{22}&\cdots&c_{2n}\\ \vdots & \vdots & \ddots & \vdots\\ c_{n1}&c_{n2}&\cdots&c_{nn}\\ \end{bmatrix}. \end{equation*}\]The diagonal elements of the matrix are the variance of the stock return, $c_{ii}=\sigma_i^2=Var(K_i)$.

The expected return and the variance of the portfolio are:

\[\begin{equation} \mu_V = \mathrm{w}\mathrm{m}^T, \end{equation}\] \[\begin{equation} \sigma_V^2 = \mathrm{w}\mathrm{C}\mathrm{w}^T \end{equation}\]Proof

\[\begin{equation*} \mu_V = E(K_V) = E(\sum_{i=1}^nw_iK_i) = \sum_{i=1}^nw_i\mu_i = \mathrm{w}\mathrm{m}^T \end{equation*}\] \[\begin{align*} \sigma_V^2 & = Var(K_V) = Var(\sum_{i=1}^nw_iK_i) \\ &= Cov(\sum_{i=1}^nw_iK_i, \sum_{j=1}^nw_jK_j) = \sum_{i,j=1}^nw_iw_jc_{ij} \\ &= \mathrm{w}\mathrm{C}\mathrm{w}^T \end{align*}\]Function for calculating the portfolio return and variance

Description of calc_port_retvar(weight_list, eret_list, std_list, corr_list, print_results=True):

Use lists of securities’ weights, expected returns, standard deviations, and pearson correlations to calculate the portfolio’s expected return and variance, and standard deviation.

Keyword arguments:

print_results=True: default isTrue, will print the portfolio’s expected return, variance/standard deviation, and the percentage of idiosyncratic variances out of the portfolio variance. IfFalse, will not print anything, but return a dictionary containing the portfolio return, variance, standard deviation, and the proportion of diagonal variances.print_var=True: default isTrue, whenprint_results=True, print the portfolio variance, ifprint_var=False, print the portfolio standard deviation.

def calc_port_retvar(weight_list, eret_list, std_list, corr_list, print_results=True, print_var=True):

port_eret = np.dot(np.array(weight_list), np.array(eret_list).transpose())

cov_mat = []

n = len(std_list)

for x in range(1,n+1):

cxy= []

for y in range(1,n+1):

if x == y:

cxy.append(std_list[x-1]**2)

elif x < y:

idx = int((y-x-1)*n-(((y-x)*(y-x-1))/2)+x)

cxy.append(corr_list[idx-1]*std_list[x-1]*std_list[y-1])

elif x > y:

idx = int((x-y-1)*n-(((x-y)*(x-y-1))/2)+y)

cxy.append(corr_list[idx-1]*std_list[x-1]*std_list[y-1])

cov_mat.append(cxy)

port_var = np.dot(np.dot(weight_list, cov_mat), np.array(weight_list).transpose())

port_sd = np.sqrt(port_var)

msv = sum(map(lambda x: x**2, std_list))/(n**2)

if print_results:

print("The portfolio's expected return is: %s" % round(port_eret, 4))

if print_var:

print("The portfolio's variance is %s" % round(port_var,4))

else:

print("The portfolio's standard deviation is %s" % round(port_sd,4))

print("The idiosyncratic variances account for %s%% of the portfolio variance" % round((msv/port_var)*100,2))

else:

vola_dict = dict()

vola_dict["return"] = port_eret

vola_dict["variance"] = port_var

vola_dict["std"] = port_sd

vola_dict["diagvar"] = msv/port_var

return vola_dict

Note: in order to use the above function, some conditions must be met:

- All the inputs are list, and in order: stock 1, stock 2, … , stock n.

- The lengths of weight_list, eret_list, and std_list should be equal to $n$.

- The lengh of corr_list equals to $\frac{n!}{2(n-2)!}$.

- Unlike the codes in Part 1, here the input is the standard deviation rather than variance.

- The correlation list should follow the combination order from smaller distance between $i$ and $j$ to larger, for example, if $n = 4$:

Then, the code will build the covariance matrix using $C_{ij} = \rho_{ij}\sigma_{i}\sigma_{j}$ to calculate the covariance for each $i$ and $j$ pair ($i\neq j$). Assuming the index for correlation list starts from 1 instead of 0. For the $n\times n$ covariance matrix, the following equation is used in the above function to identify the index correlation list for the pair $i,j$:

\[\begin{equation*} \mathrm{index} = (|i-j|-1)n-\frac{|i-j|}{2}(|i-j|-1)+min(i,j) \end{equation*}\]weight_list = [0.4, -0.2, 0.8]

eret_list = [0.08, 0.1, 0.06]

std_list = [0.15, 0.05, 0.12]

corr_list = [0.3, 0, -0.2]

calc_port_retvar(weight_list, eret_list, std_list, corr_list, print_results=True, print_var=False)

calc_port_retvar(weight_list, eret_list, std_list, corr_list, print_results=False)

The portfolio's expected return is: 0.06

The portfolio's standard deviation is 0.1013

The idiosyncratic variances account for 42.7% of the portfolio variance

{'return': 0.06,

'variance': 0.010252,

'std': 0.10125216047077712,

'diagvar': 0.4270169506221008}

Why portfolio diversification can reduce the unsystematic risk?

Assume the stocks in the portfolio are equal-weighted, which means $w_i=\frac{1}{n}$. If the portfolio is diversified enough ($n \to \infty$), the unsystematic risk of individual security will be eliminated. The systematic risk will remain. This statement under such assumption can be proved as follow:

Proof

\[\begin{align*} \sigma_V^2 &= \frac{1}{n^2}\sum_{i=1}^nVar(K_i) + \frac{1}{n^2}\sum_{i,j=1; i\neq j}^nCov(K_i, K_j) \\ &= \frac{1}{n}\frac{1}{n}\sum_{i=1}^nVar(K_i) + \frac{n^2-n}{n^2}\frac{1}{n^2-n}\sum_{i,j=1; i\neq j}^nCov(K_i, K_j) \\ &= \frac{1}{n}E[Var(K_i))] + \frac{n^2-n}{n^2}E[Cov(K_i, K_j)] \end{align*}\]In a well-diversified portfolio, when $n \to \infty$, $\frac{1}{n} \to 0$ and $\frac{n^2-n}{n^2} \to 1$. Therefore, only the covariance contributes to the volatility ($\sigma_V$) of such well-diversified portfolio.

Description of plot_corr_matrix(n_sample, dataframe, plot_heat=True):

Randomly select a number of sample from a time-series financial return data with every column for every stock, print the number of stocks, equal-weighted portfolio expected return, equal-weighted portfolio standard deviation, and the percentage decrease in the portfolio variance, and plot seaborn.heatmap for the portfolio’s correlation matrix. When keyword argument plot_heat=False, will only return a dictionary containing the portfolio return, variance, and standard deviation.

Arguments:

n_sample(type: int): number of sample that are randomly selected from the data set. If exceed the index range of data set,n_samplewill equal the length of the data set minus 10 (or equal 1 if still out of index range).dataframe(type: Pandas DataFrame): read from the link to the Github raw file “crsp_small_sample.xlsx”. The file is a small time-series sample containing 906 CRSP monthly stock returns randomly selected from all industries (excl. financial) as columns, from January 2010 to December 2020.plot_heat=True: default isTrue, will plotseaborn.heatmapfor the portfolio’s correlation matrix, and print the number of stocks, equal-weighted portfolio expected return, equal-weighted portfolio standard deviation, and the percentage of idiosyncratic variances out of the portfolio variance. IfFalse, will only return a dictionary containing the portfolio return, variance, standard deviation, and the proportion of diagonal variances.

def plot_corr_matrix(n_sample, dataframe, plot_heat=True):

df = dataframe

if n_sample < len(df.columns) and n_sample > 0:

num = n_sample

else:

try:

num = len(df.columns) - 10

except:

num = 1

print("[Error] number out of range. Plot default sample.")

df_sample = pd.concat([df["yrm"], df.loc[:,df.columns!="yrm"].sample(n=num,axis='columns',replace=False)], axis=1)

weight_list = [1/(len(df_sample.columns)-1)] * (len(df_sample.columns)-1)

eret_list = [df_sample[df_sample.columns[i]].mean() for i in range(1, len(df_sample.columns))]

std_list = [df_sample[df_sample.columns[i]].std() for i in range(1, len(df_sample.columns))]

corr_list = []

for distance in range(1, len(df_sample.columns)-1):

i = 1

next_i = i + distance

while next_i <= len(df_sample.columns)-1:

correlation = df_sample[df_sample.columns[i]].corr(df_sample[df_sample.columns[next_i]])

corr_list.append(correlation)

i += 1

next_i = i + distance

if plot_heat:

print("Number of stocks in the EW portfolio: %s" % num)

calc_port_retvar(weight_list, eret_list, std_list, corr_list, print_results=True, print_var=False)

corr_mat = df_sample.corr()

f = plt.figure(figsize = (10,6))

ax = sns.heatmap(corr_mat)

plt.show()

else:

return calc_port_retvar(weight_list, eret_list, std_list, corr_list, print_results=False)

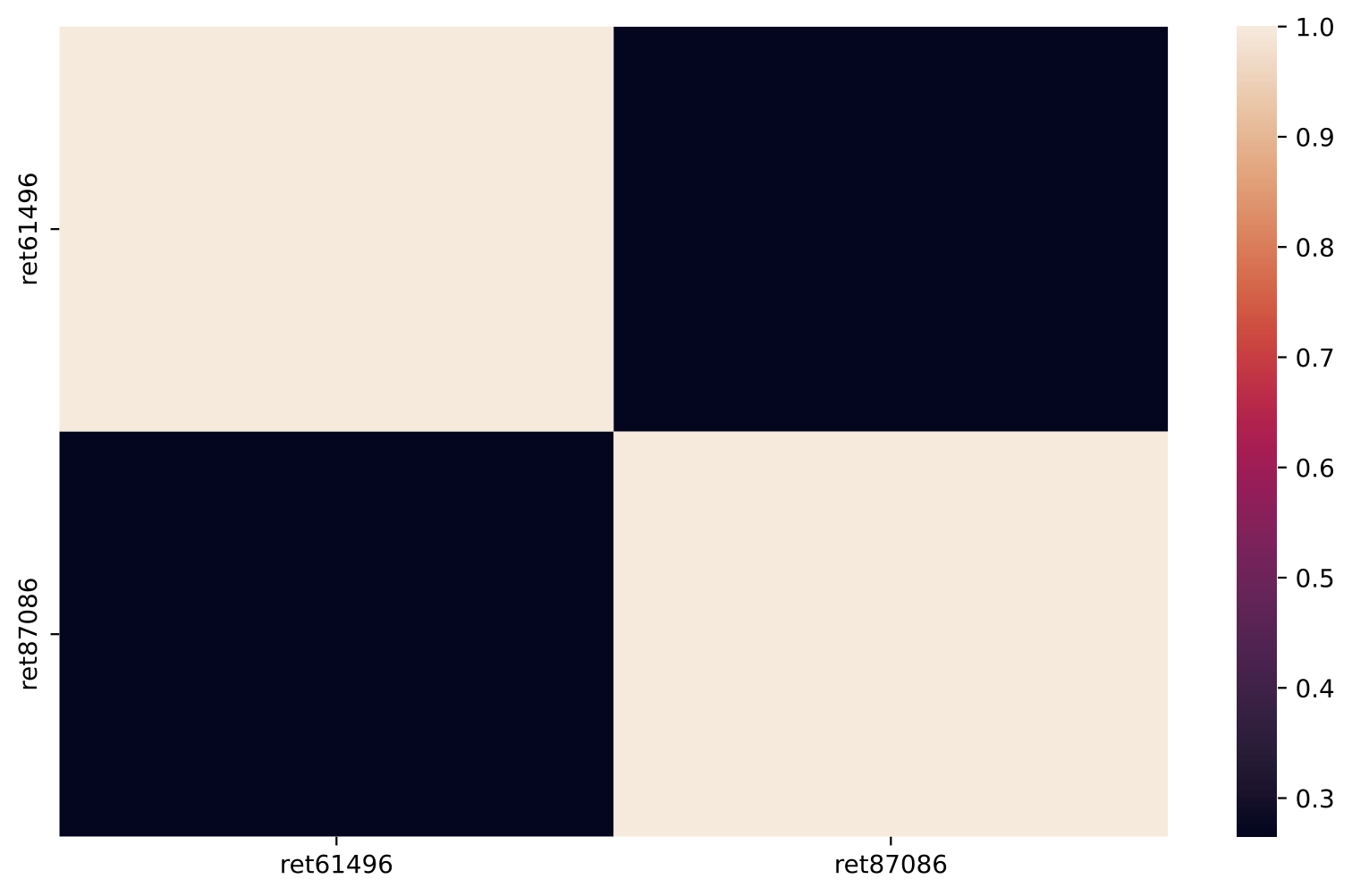

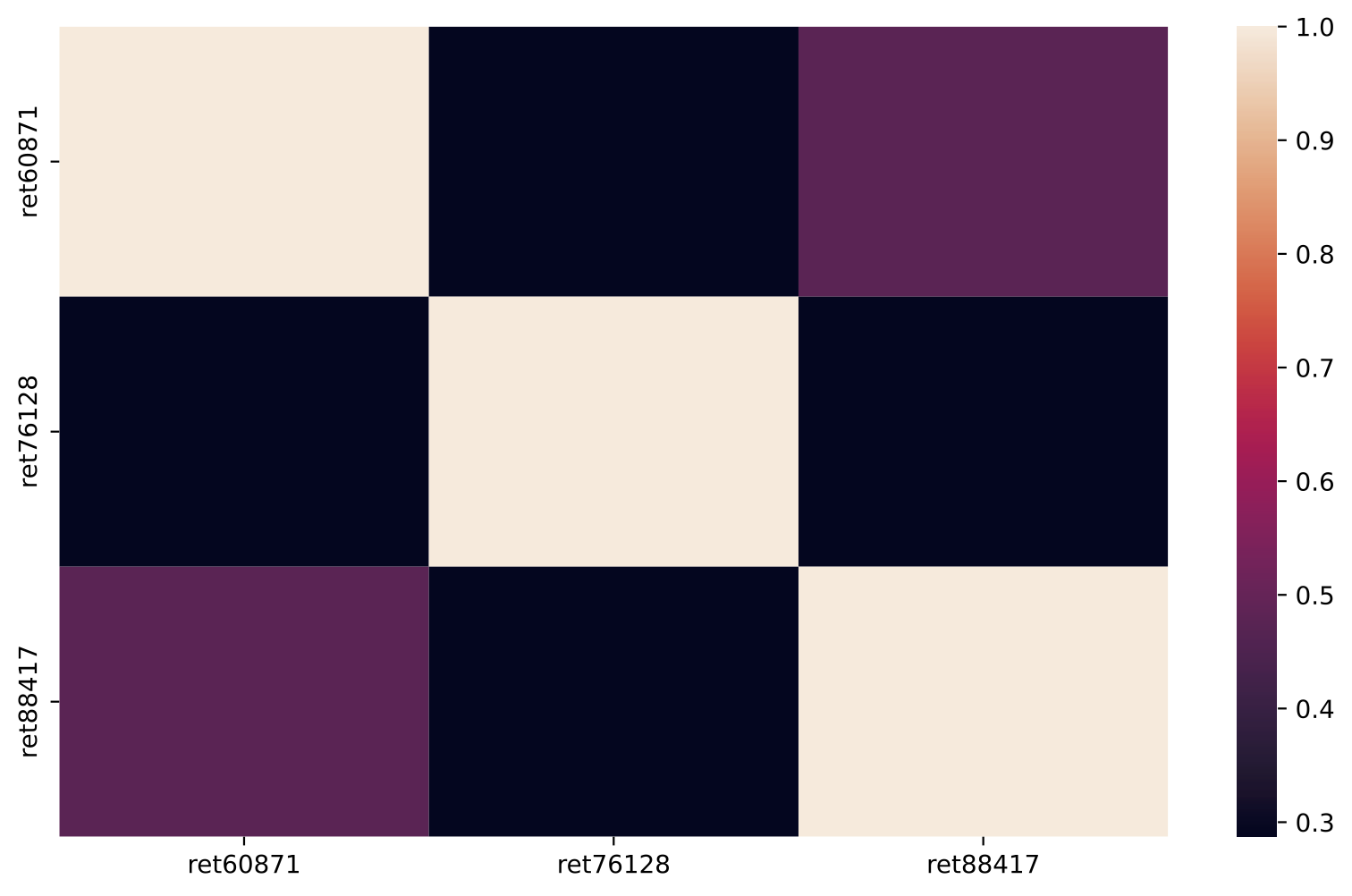

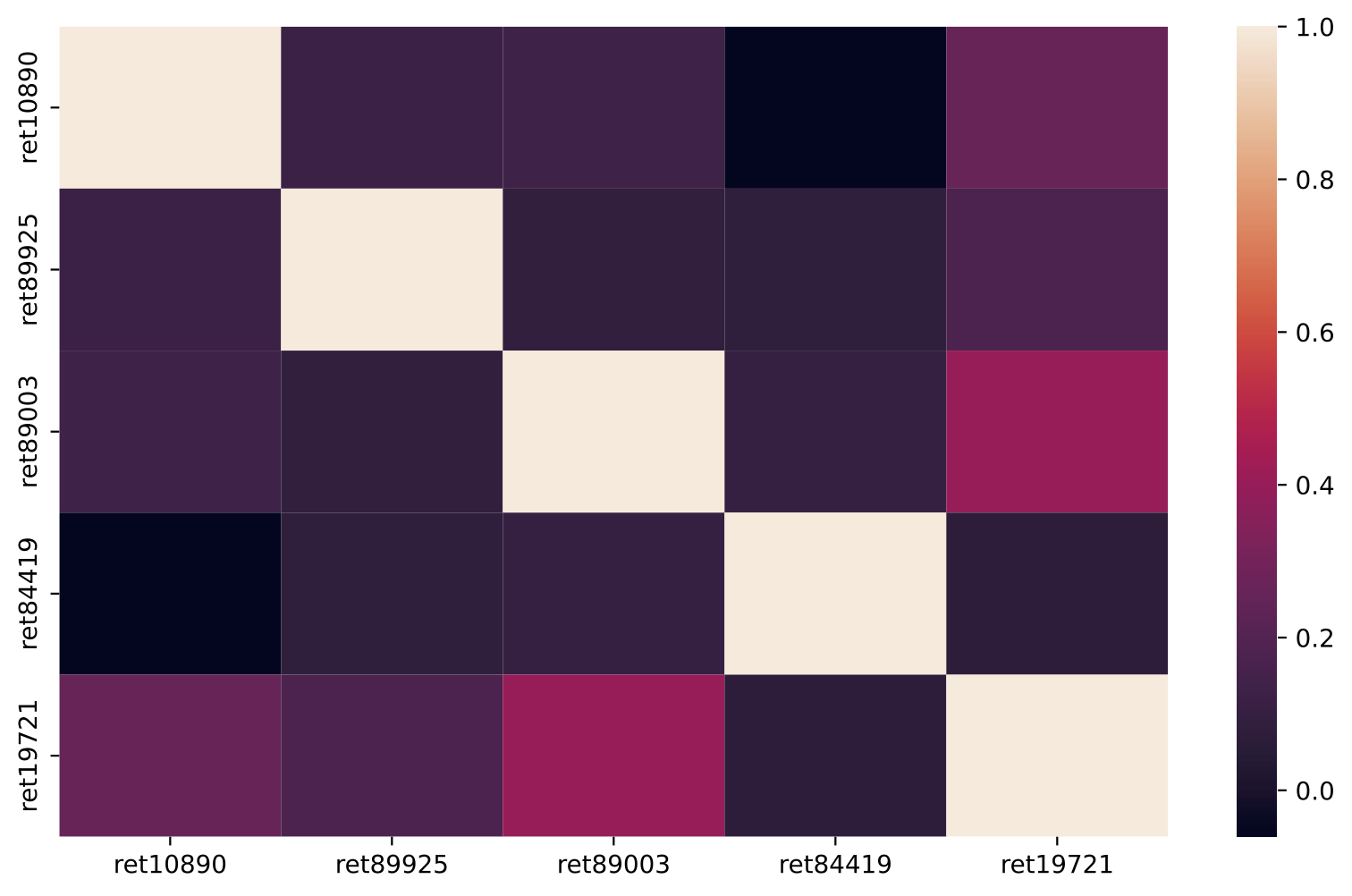

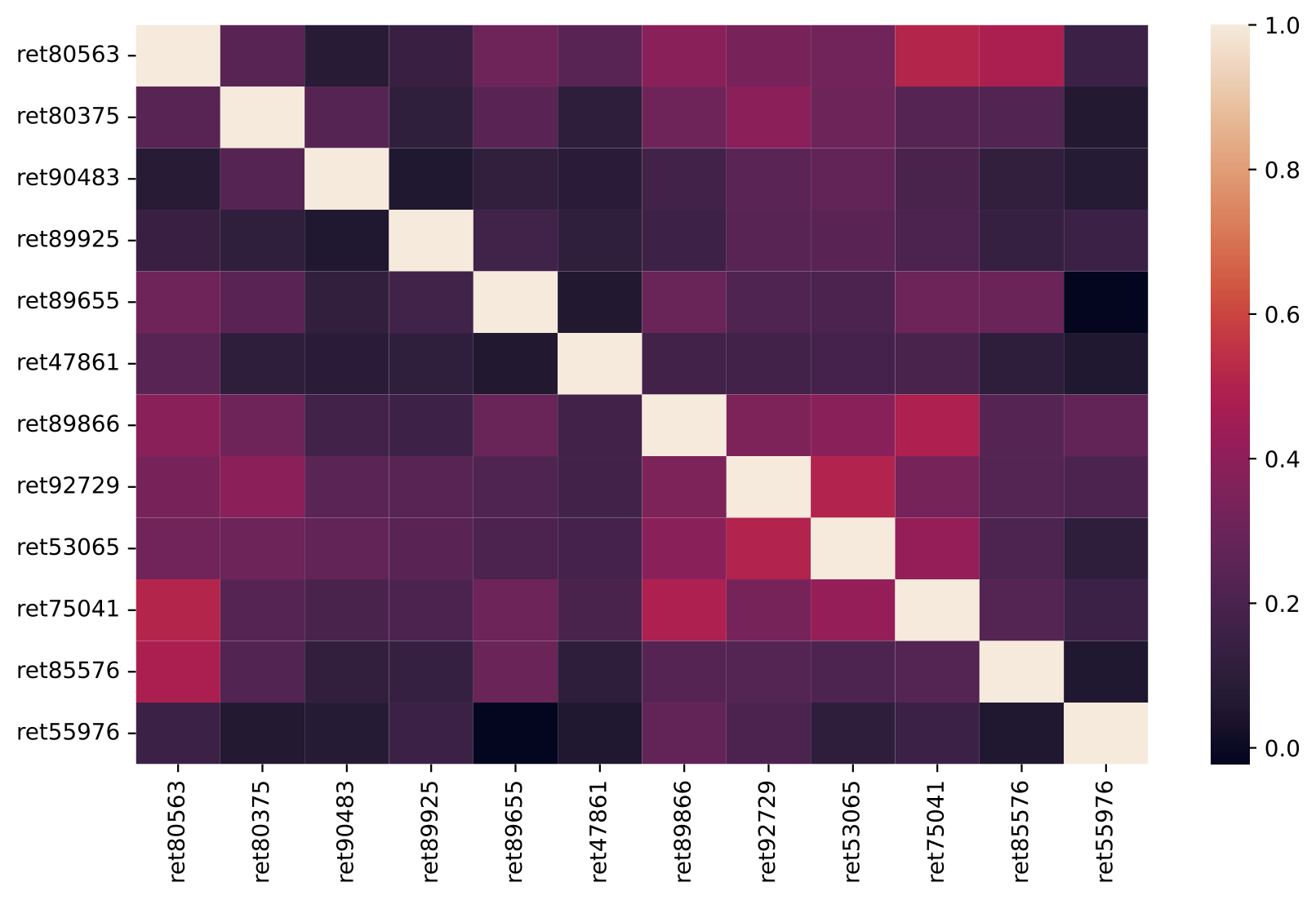

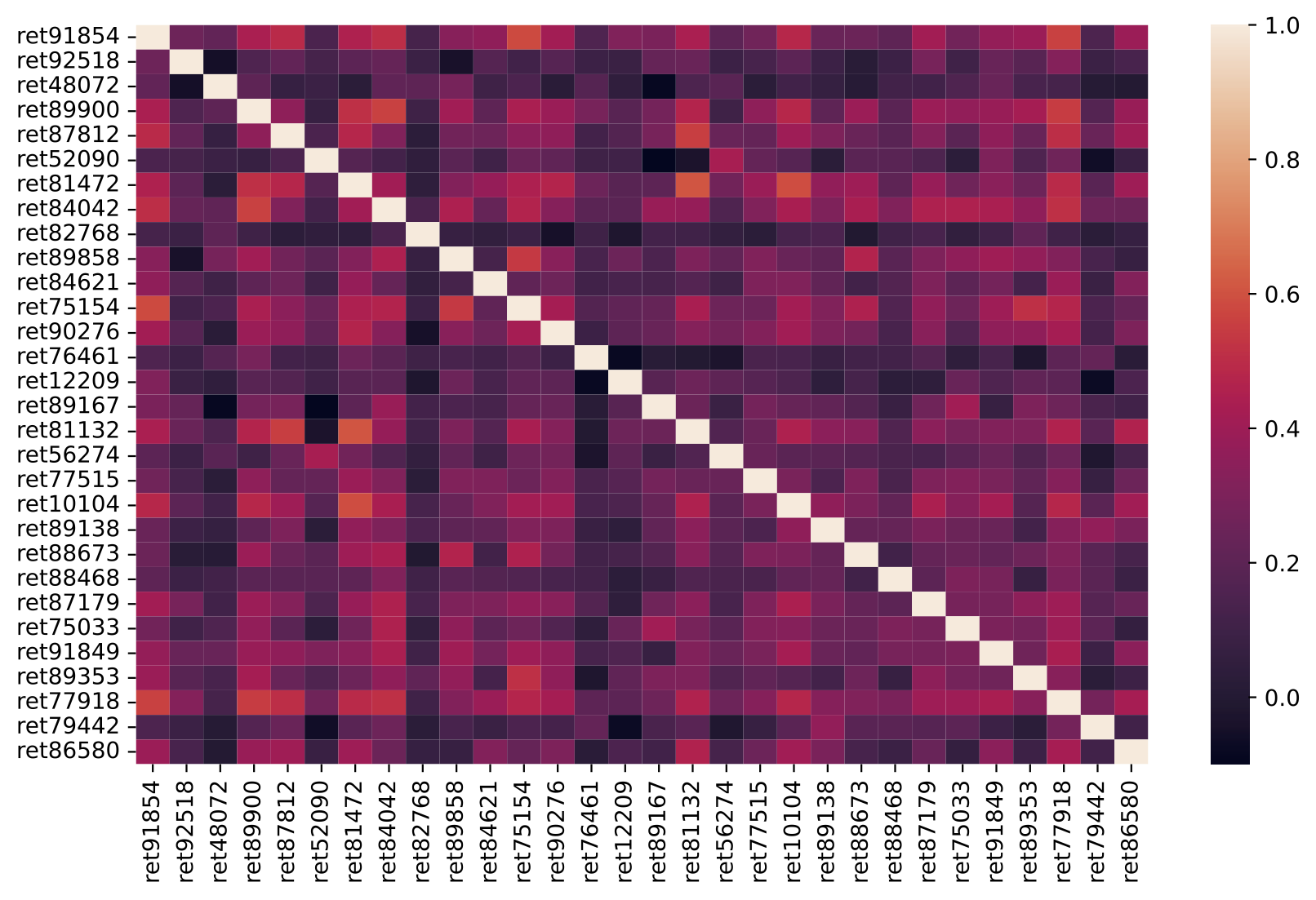

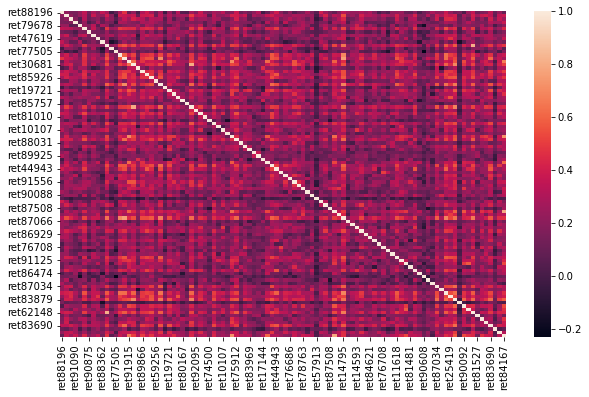

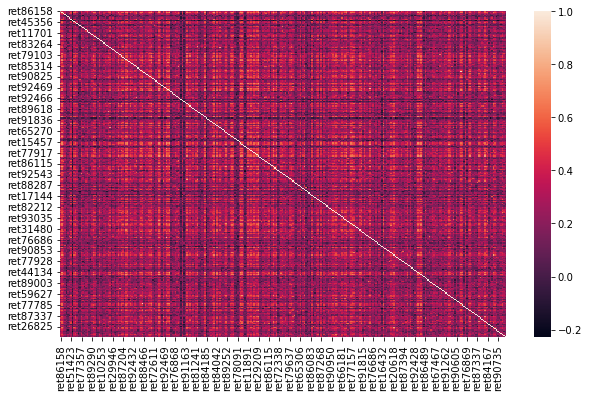

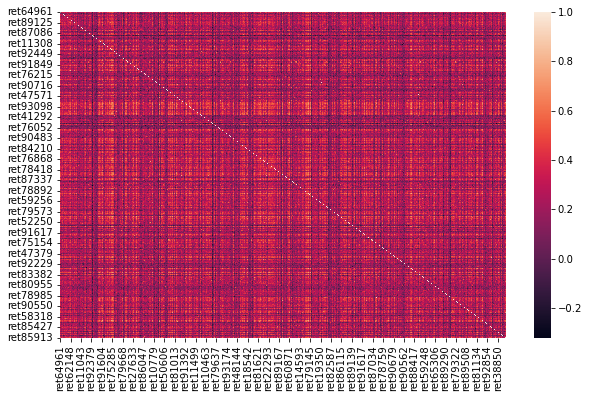

Heatmaps of correlation matrix

First, we can plot a series of correlation matrix heatmaps for different number of stocks in the portfolio. numList contains a list of the number of stocks that will be randomly selected from the main dataset into the portfolio.

The plots below shows the proportion of idiosyncratic volatility (indicated by the diagonal light color squares) is decreasing when there are more and more stocks in the portfolio, consistent with the statement that only the covariance contributes to the volatility of an ideally well-diversified portfolio ($n \to \infty$)

numList = [2, 3, 5, 12, 30, 100, 300, 900]

sample_url = "https://raw.github.com/evanhaozhao/Python-for-mathematical-finance/main/data/crsp_small_sample.xlsx"

df = pd.read_excel(sample_url)

for n_sample in tqdm(numList):

plot_corr_matrix(n_sample, df, plot_heat=True)

Number of stocks in the EW portfolio: 2

The portfolio's expected return is: 0.0112

The portfolio's standard deviation is 0.1054

The idiosyncratic variances account for 89.06% of the portfolio variance

Number of stocks in the EW portfolio: 3

The portfolio's expected return is: 0.0075

The portfolio's standard deviation is 0.0942

The idiosyncratic variances account for 73.58% of the portfolio variance

Number of stocks in the EW portfolio: 5

The portfolio's expected return is: 0.0132

The portfolio's standard deviation is 0.0715

The idiosyncratic variances account for 49.05% of the portfolio variance

Number of stocks in the EW portfolio: 12

The portfolio's expected return is: 0.0169

The portfolio's standard deviation is 0.0741

The idiosyncratic variances account for 25.33% of the portfolio variance

Number of stocks in the EW portfolio: 30

The portfolio's expected return is: 0.0177

The portfolio's standard deviation is 0.0553

The idiosyncratic variances account for 19.1% of the portfolio variance

Number of stocks in the EW portfolio: 100

The portfolio's expected return is: 0.0152

The portfolio's standard deviation is 0.0546

The idiosyncratic variances account for 6.25% of the portfolio variance

Number of stocks in the EW portfolio: 300

The portfolio's expected return is: 0.0138

The portfolio's standard deviation is 0.0572

The idiosyncratic variances account for 1.85% of the portfolio variance

Number of stocks in the EW portfolio: 900

The portfolio's expected return is: 0.0135

The portfolio's standard deviation is 0.0559

The idiosyncratic variances account for 0.62% of the portfolio variance

Random selection for number of stocks

Use below cell to test the random sample selection function of plot_corr_matrix with plot_heat=False, under which circumstance the output of plot_corr_matrix is a dictionary.

plot_corr_matrix(10, df, plot_heat=False)

{'return': 0.013411779090496238,

'variance': 0.004974473748940599,

'std': 0.07052994930482084,

'diagvar': 0.3784352862914476}

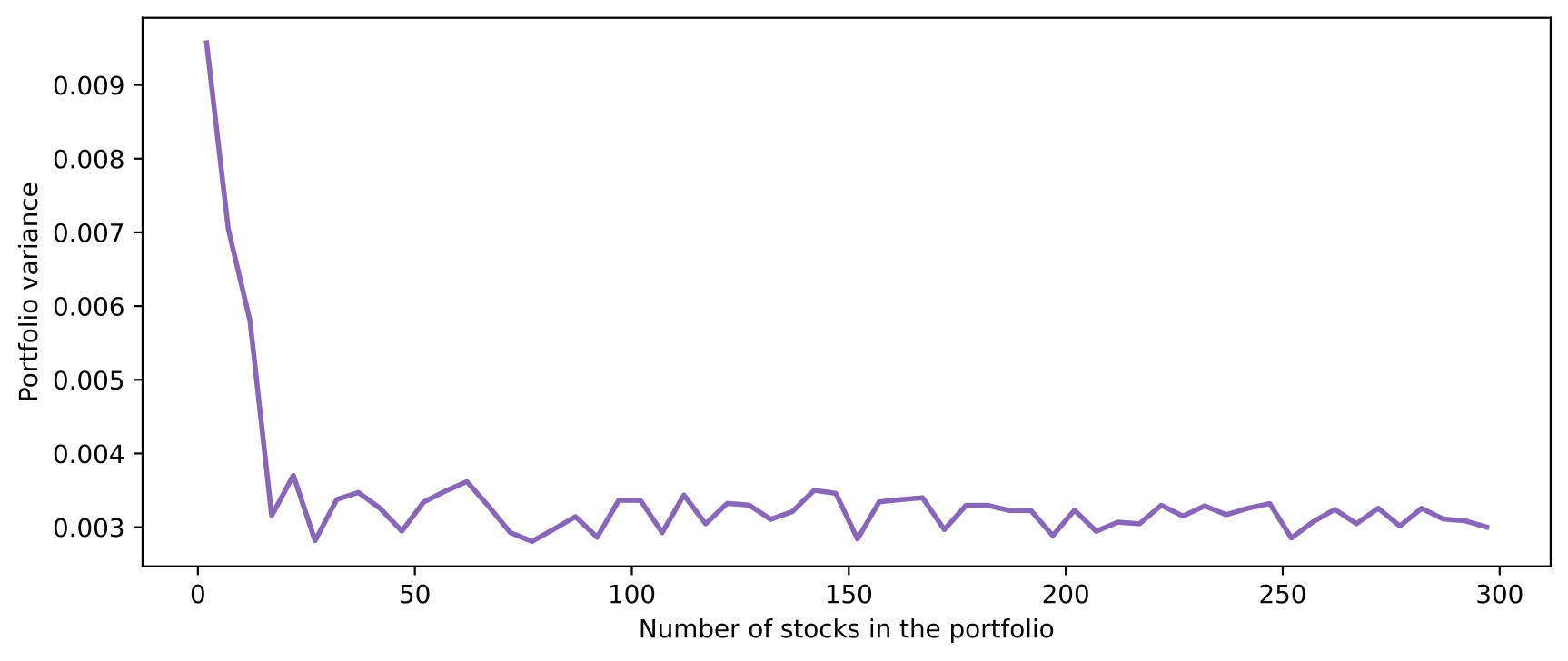

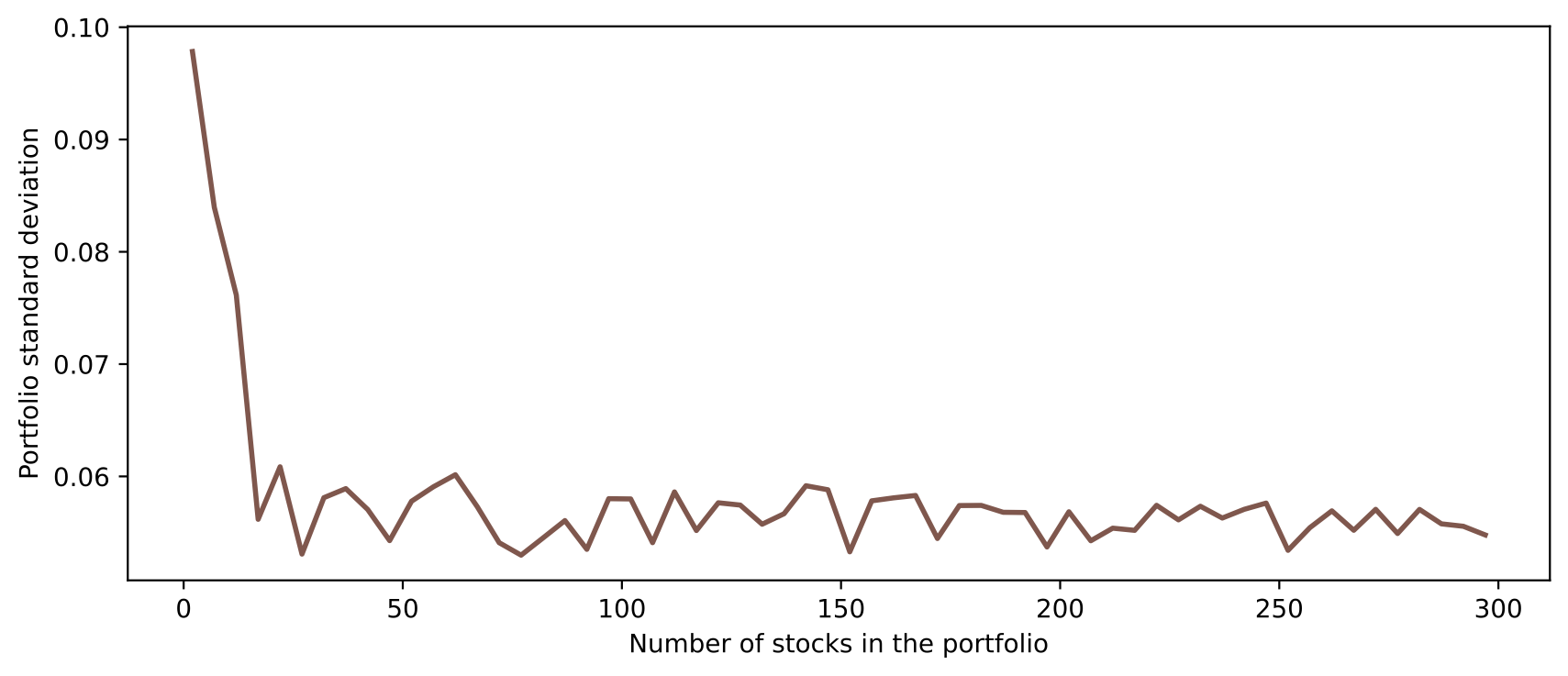

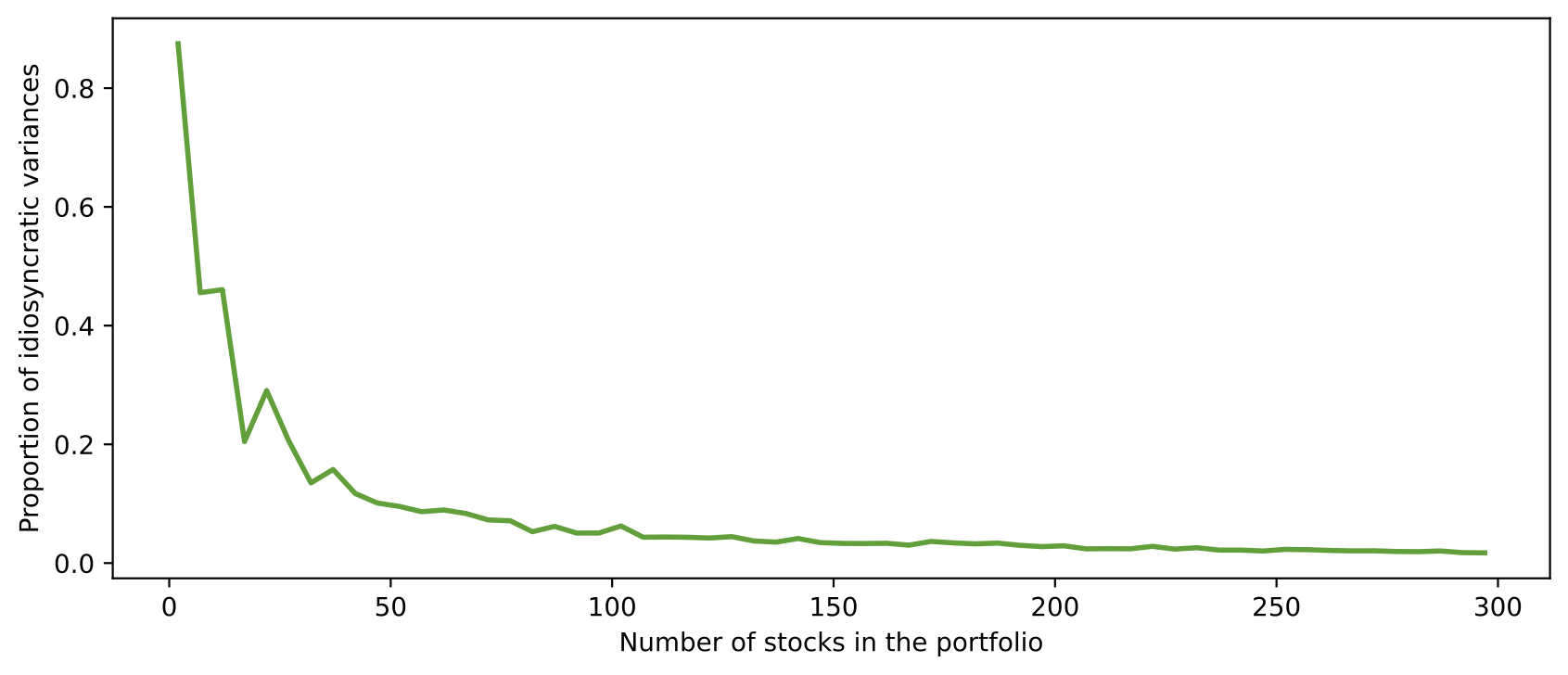

To further illustrate the effect of diversification on variance, we construct a DataFrame called df_retvar with each row as a portfolio consisting of different number of stocks randomly selected from the previous CRSP sample file.

list_ret_var = []

for i in tqdm(range(2,300,5)):

dict_ret_var = plot_corr_matrix(i, df, plot_heat=False)

dict_ret_var["num_stock"] = i

list_ret_var.append(dict_ret_var)

df_retvar = pd.DataFrame(list_ret_var)

df_retvar.head(10)

| return | variance | std | diagvar | num_stock | |

|---|---|---|---|---|---|

| 0 | 0.012502 | 0.009062 | 0.095192 | 0.934812 | 2 |

| 1 | 0.014243 | 0.006508 | 0.080669 | 0.515348 | 7 |

| 2 | 0.018026 | 0.004661 | 0.068269 | 0.502222 | 12 |

| 3 | 0.019046 | 0.003799 | 0.061633 | 0.298044 | 17 |

| 4 | 0.014085 | 0.003250 | 0.057006 | 0.167664 | 22 |

| 5 | 0.016742 | 0.004234 | 0.065068 | 0.163414 | 27 |

| 6 | 0.014426 | 0.004853 | 0.069664 | 0.137153 | 32 |

| 7 | 0.012808 | 0.003722 | 0.061010 | 0.109052 | 37 |

| 8 | 0.013808 | 0.002744 | 0.052387 | 0.120151 | 42 |

| 9 | 0.013791 | 0.003035 | 0.055090 | 0.102587 | 47 |

Volatility line chart

From the line chart below, we observe when the number of stocks in the portfolio increase, the portfolio’s volatility and the proportion of idiosyncratic variance decrease.

col_dict = {"variance":"Portfolio variance", "std": "Portfolio standard deviation", \

"diagvar": "Proportion of idiosyncratic variances"}

for k, v in col_dict.items():

f = plt.figure(figsize=(10, 4))

color = random.choice(list(mcolors.TABLEAU_COLORS.values()))

plt.plot("num_stock", k, data=df_retvar, c=color, ls='-', lw=2)

plt.xlabel("Number of stocks in the portfolio")

plt.ylabel("%s" % v)

plt.show()

Minimum variance portfolio

Proposition of minimum variance portfolio

Assume $\mathrm{det}$ $\mathrm{C} \neq 0$, the portfolio with the smallest variance in the attainable set has weights:

\[\begin{equation} \mathrm{w} = \frac{\mathrm{uC}^{-1}}{\mathrm{uC}^{-1}\mathrm{u}^T} \end{equation}\]Proof

We need to find the minimum of the portfolio variance $\sigma_V^2 = \mathrm{w}\mathrm{C}\mathrm{w}^T$ subject to the constraint $\mathrm{w}\mathrm{u}^T=1$. To this end we can use the method of Lagrange multipliers:

\[\begin{align*} \mathrm{F}(\mathrm{w},\lambda) = \mathrm{w}\mathrm{C}\mathrm{w}^T − \lambda(\mathrm{w}\mathrm{u}^T-1), \end{align*}\]where $\lambda$ is a Lagrange multiplier. Equating to zero the partial derivatives of $F$ with respect to the weights $w_i$ we obtain $2\mathrm{w}\mathrm{C} − \lambda \mathrm{u} = 0$, that is:

\[\begin{align*} \mathrm{w}=\frac{\lambda}{2}\mathrm{u}\mathrm{C}^{-1}, \end{align*}\]which is a necessary condition for a minimum. Substituting this into constraint $\mathrm{w}\mathrm{u}^T=1$, we obtain:

\[\begin{align*} \frac{\lambda}{2}\mathrm{u}\mathrm{C}^{-1}\mathrm{u}^T=1, \end{align*}\]where we use the fact that $\mathrm{C}^{−1}$ is a symmetric matrix because $C$ is. Solving this for $\lambda$ and substituting the result into the expression for $\mathrm{w}$ will give the asserted formula.

Function for calculating the weights of MVP

Below is the function to calculate the weights, return, and variance of the minimum variance portfolio.

Description of cal_mvp(eret_list, std_list, corr_list, return_type="weight_list"):

Arguments

eret_list,std_list,corr_list: like what we did before, these three parameters are lists of stock returns, standard deviations, and correlations (see previous Note for the required correlation order in the list)return_type="weight_list": default is to return a list of weights with minimum portfolio variance. Besides, there are two options:"full_print"to print the minimum variance portfolio’s weights, return and variance;"dictionary"to return a dictionary of the minimum variance portfolio’s return and variance.

def cal_mvp(eret_list, std_list, corr_list, return_type="weight_list"):

cov_mat = []

n = len(std_list)

u = np.array([1] * n)

for x in range(1,n+1):

cxy= []

for y in range(1,n+1):

if x == y:

cxy.append(std_list[x-1]**2)

elif x < y:

idx = int((y-x-1)*n-(((y-x)*(y-x-1))/2)+x)

cxy.append(corr_list[idx-1]*std_list[x-1]*std_list[y-1])

elif x > y:

idx = int((x-y-1)*n-(((x-y)*(x-y-1))/2)+y)

cxy.append(corr_list[idx-1]*std_list[x-1]*std_list[y-1])

cov_mat.append(cxy)

weight_array = np.dot(u,np.linalg.inv(cov_mat))/np.dot(np.dot(u,np.linalg.inv(cov_mat)),u.transpose())

weight_list = list(weight_array)

port_eret = np.dot(np.array(weight_list), np.array(eret_list).transpose())

port_var = np.dot(np.dot(weight_list, cov_mat), np.array(weight_list).transpose())

if return_type == "weight_list":

return weight_list

elif return_type == "full_print":

weight_round = list(np.round(weight_array,3))

print("Weights for the minimum variance portfolio are: %s, sum to %s" %(weight_round, round(np.sum(weight_array),0)))

print("The portfolio's expected return is: %s" % round(port_eret, 4))

print("The portfolio's variance is %s" % round(port_var,4))

try:

print("The portfolio's standard deviation is %s" % round(np.sqrt(port_var),4))

except:

pass

elif return_type == "dictionary":

vola_dict = dict()

vola_dict["return"] = port_eret

vola_dict["variance"] = port_var

return vola_dict

eret_list = [0.2, 0.13, 0.17]

std_list = [0.25, 0.28, 0.2]

corr_list = [0.3, 0, 0.15]

cal_mvp(eret_list, std_list, corr_list, return_type="full_print")

Weights for the minimum variance portfolio are: [0.228, 0.235, 0.537], sum to 1

The portfolio's expected return is: 0.1674

The portfolio's variance is 0.0232

The portfolio's standard deviation is 0.1523

def calSampleMVP(n_sample, dataframe, return_dict=False):

df = dataframe

if n_sample < len(df.columns) and n_sample > 0:

num = n_sample

else:

try:

num = len(df.columns) - 10

except:

num = 1

print("[Error] number out of range. Plot default sample.")

df_sample = pd.concat([df["yrm"], df.loc[:,df.columns!="yrm"].sample(n=num,axis='columns',replace=False)], axis=1)

corr_list = []

for distance in range(1, len(df_sample.columns)-1):

i = 1

next_i = i + distance

while next_i <= len(df_sample.columns)-1:

correlation = df_sample[df_sample.columns[i]].corr(df_sample[df_sample.columns[next_i]])

corr_list.append(correlation)

i += 1

next_i = i + distance

eret_list = [df_sample[df_sample.columns[i]].mean() for i in range(1, len(df_sample.columns))]

std_list = [df_sample[df_sample.columns[i]].std() for i in range(1, len(df_sample.columns))]

weight_list = cal_mvp(eret_list, std_list, corr_list, return_type="weight_list")

if return_dict:

return cal_mvp(eret_list, std_list, corr_list, return_type="dictionary")

else:

return cal_mvp(eret_list, std_list, corr_list, return_type="full_print")

calSampleMVP(20, df, return_dict=False)

Weights for the minimum variance portfolio are: [0.11, -0.03, 0.332, 0.198, -0.076, 0.242, 0.022, -0.031, -0.006, -0.031, -0.004, 0.107, -0.076, -0.003, 0.038, 0.157, 0.008, -0.002, 0.019, 0.026], sum to 1

The portfolio's expected return is: 0.0128

The portfolio's variance is 0.0014

The portfolio's standard deviation is 0.0372

listMVP = []

for i in tqdm(range(2,300,5)):

dictMVP = calSampleMVP(i, df, return_dict=True)

dictMVP["num_stock"] = i

listMVP.append(dictMVP)

df_mvp = pd.DataFrame(listMVP).rename(columns={"return":"return_mvp","variance":"variance_mvp"})

df_mvp.head(10)

| return_mvp | variance_mvp | num_stock | |

|---|---|---|---|

| 0 | 0.021523 | 0.008861 | 2 |

| 1 | 0.021569 | 0.004338 | 7 |

| 2 | 0.008988 | 0.001278 | 12 |

| 3 | 0.013424 | 0.001106 | 17 |

| 4 | 0.013455 | 0.001170 | 22 |

| 5 | 0.011322 | 0.001348 | 27 |

| 6 | 0.012898 | 0.001158 | 32 |

| 7 | 0.013765 | 0.000795 | 37 |

| 8 | 0.013728 | 0.000667 | 42 |

| 9 | 0.012839 | 0.000811 | 47 |

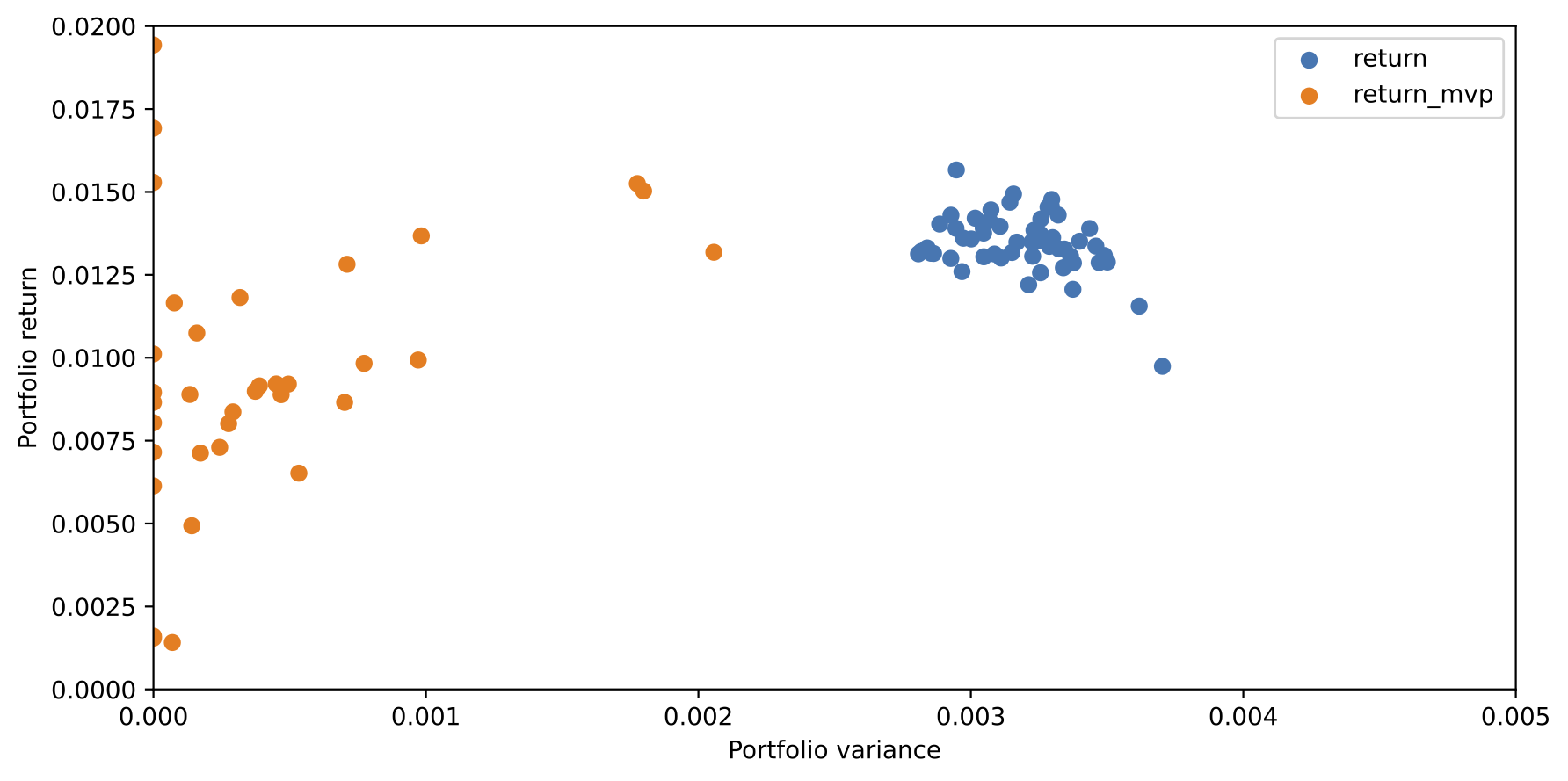

We can plot portfolio variance and return of different portfolio weights. Blue portfolios are equal weighted, while orange portfolios are weighted by minimum variance weights.

f = plt.figure(figsize=(10,5))

plt.scatter("variance", "return", data=df_retvar)

plt.scatter("variance_mvp", "return_mvp", data=df_mvp)

plt.xlim(0,0.005)

plt.ylim(0,0.02)

plt.xlabel("Portfolio variance")

plt.ylabel("Portfolio return")

plt.legend()

plt.show()