MPT Part 1: Two Securities Portfolio

Published:

Modelling and visualisation on some of the financial engineering theorems using Jupyter Notebook. The mathematics of the theorems follow the book: Capinski, M. and Zastawniak, T. (2011). Mathematics for Finance. An Introduction to Financial Engineering (Second Edition).

Check the Jupyter Notebook in my Github repository Python-for-mathematical-finance , or run the code in Google Colab MPT Part 1 - Two Securities Portfolio .

Table of Contents

Two Securities Portfolio

import numpy as np

import matplotlib as mpl

import matplotlib.pyplot as plt

import matplotlib.colors as mcolors

import matplotlib.patches as mpatches

import scipy.stats as stats

import pandas as pd

import pandas_datareader as pdr

import random

from adjustText import adjust_text

from tqdm.notebook import tqdm

tqdm.pandas()

Theorems for the feasible set

For two risky assets, the portfolio return is:

\[\begin{equation} \mu_{v} = w_1 \mu_1 + w_2 \mu_2, \end{equation}\]and the variance is:

\[\begin{equation} \sigma^2_V = w^2_1 \sigma^2_1 + w^2_2 \sigma^2_2 + 2w_1w_2c_{12}. \end{equation}\]Here, $w_1, w_2 \in \mathbb{R}$, and $1 = w_1 + w_2$.

We use $s$ to represent the $w_1$, then the $w_2 = 1 - s$. The above equation would be:

\[\begin{equation*} \mu_{v} = s \mu_1 + (1-s) \mu_2, \end{equation*}\] \[\begin{equation*} \sigma^2_V = s^2 \sigma^2_1 + (1-s)^2 \sigma^2_2 + 2s(1-s)c_{12}. \end{equation*}\]Here $s \in \mathbb{R}$.

If $\rho < 1$, or $\sigma_1 \neq \sigma_2$, the weight of asset 1, $s_0$, with mimimum varaince $\sigma_V^2$, will be:

\[\begin{equation} s_0 = \frac{\sigma_2^2 - c_{12}}{\sigma_1^2+\sigma_2^2-2c_{12}}, \end{equation}\]And the expected return $\mu_V$ and variance $\sigma_V^2$ will be:

\[\begin{equation} \mu_0=\frac{\mu_1\sigma_2^2+\mu_2\sigma_1^2-(\mu_1+\mu_2)c_{12}}{\sigma_1^2+\sigma_2^2-2c_{12}}, \end{equation}\] \[\begin{equation} \sigma_0^2=\frac{\sigma_1^2\sigma_2^2-c_{12}^2}{\sigma_1^2+\sigma_2^2-2c_{12}}. \end{equation}\]If $-1<\rho_{12}<1$ and $\mu_1\neq mu_2$, then for each feasible set in the portfolio $V$, $x=\sigma_V$ and $y=\mu_V$ satisfy the following equation:

\[\begin{equation} x^2-A^2(y-\mu_0)^2=\sigma_0^2, \end{equation}\]where

\[\begin{equation*} A^2 = \frac{\sigma_1^2+\sigma_2^2-2c_{12}}{(\mu_1-\mu_2)^2}>0, \end{equation*}\]whose asymptotes are:

\[\begin{equation*} y=\mu_0 \pm \frac{1}{A}x. \end{equation*}\]# When separate_plot=True (default), the corr12 should be a digit imput.

# When separate_plot=False, the corr12 needs to be a list of situations.

def two_asset_plot(mu1, mu2, var1, var2, corr12, separate_plot=True):

def strategy_idfier(weight):

strat_ls = ["long", "short", "ignore"]

if weight>0:

strategy = strat_ls[0]

elif weight<0:

strategy = strat_ls[1]

else:

strategy = strat_ls[2]

return strategy

if separate_plot:

if var2 == 0:

var_rf = var2

var2 += 0.0000000000001

else:

var_rf = var2

cov12 = corr12*np.sqrt(var1)*np.sqrt(var2)

s0 = (var2-cov12)/(var1+var2-2*cov12)

mu0 = (mu1*var2+mu2*var1-(mu1+mu2)*cov12)/(var1+var2-2*cov12)

var0 = (var1*var2-cov12**2)/(var1+var2-2*cov12)

sd1sd2 = np.sqrt(var1)/np.sqrt(var2)

if var_rf == 0:

print("[Special situation]: one risky, another risk free")

else:

if corr12 == 1:

print("[Situation 1]: correlation equals 1")

elif corr12 > np.sqrt(var1)/np.sqrt(var2) and corr12 < 1:

print("[Situation 2]: correlation between STD1/STD2 (%s) and 1" %round(sd1sd2,4))

elif corr12 == np.sqrt(var1)/np.sqrt(var2):

print("[Situation 3]: correlation equals STD1/STD2 (%s)" %round(sd1sd2,4))

elif corr12 < np.sqrt(var1)/np.sqrt(var2) and corr12 > -1:

print("[Situation 4]: correlation between -1 and STD1/STD2 (%s)" %round(sd1sd2,4))

elif corr12 == -1:

print("[Situation 5]: correlation equals -1")

else:

print("[Error: correlation out of range]")

print("MVP strategy (weight): %s asset 1 (%s%%), and %s asset 2 (%s%%)"

%(strategy_idfier(round(s0,4)),round(100*s0,2),strategy_idfier(round(1-s0,4)),round(100*(1-s0),2)))

print("Return of MVP: %s" % round(mu0,4))

print("Minimum variance: %s" % round(var0,4))

print("Covariance: %s" % round(cov12,4))

f = plt.figure(figsize = (10,8))

ax = f.add_subplot(1, 1, 1)

x = np.linspace(0, max((np.sqrt(var1),np.sqrt(var2)))*(5/3), 400)

y = np.linspace(min(mu1,mu2,mu0)-np.abs(2/3)*max(mu1,mu2,mu0), max(mu1,mu2,mu0)+np.abs((2/3)*max(mu1,mu2,mu0)), 400)

x, y = np.meshgrid(x, y)

x2 = np.linspace(0, max(np.sqrt(var1),np.sqrt(var2),np.sqrt(np.abs(var0)))*(5/3))

y2 = mu0+np.sqrt((((mu1-mu2)**2)/(var1+var2-2*cov12)))*x2

y3 = mu0-np.sqrt((((mu1-mu2)**2)/(var1+var2-2*cov12)))*x2

plt.plot(x2, y2,color='grey',lw=1,ls='--')

plt.plot(x2, y3,color='grey',lw=1,ls='--')

formula = ((y-mu0)**2-(x**2-var0)*(((mu1-mu2)**2)/(var1+var2-2*cov12)))

masked_long = (y<min(mu1,mu2))|(max(mu1,mu2)<y)

masked_short = (y>=min(mu1,mu2))&(y<=max(mu1,mu2))

plt.contour(np.ma.masked_where(masked_long,x),np.ma.masked_where(masked_long,y),np.ma.masked_where(masked_long,formula), [0], colors='deepskyblue', linestyles='-')

plt.contour(np.ma.masked_where(masked_short,x),np.ma.masked_where(masked_short,y),np.ma.masked_where(masked_short,formula), [0], colors='deepskyblue', linestyles='--')

plt.hlines(mu0,0,np.sqrt(np.abs(var0)),color='grey',lw=1,ls='--')

plt.vlines(np.sqrt(np.abs(var0)),0,mu0,color='grey',lw=1,ls='--')

two_assets = [[np.sqrt(var1), np.sqrt(var2)], [mu1, mu2]]

plt.scatter(*two_assets, marker='v', color='red')

text1 = plt.text(np.sqrt(var1), mu1, "(σ1, μ1)")

text2 = plt.text(np.sqrt(var2), mu2, "(σ2, μ2)")

min_var = [[np.sqrt(np.abs(var0))], [mu0]]

plt.scatter(*min_var, marker='x', color='purple')

text3 = plt.text(np.sqrt(np.abs(var0)), mu0, "Min(σ)")

adjust_text([text1, text2, text3])

plt.xlabel("Standard Deviation (σ)")

plt.ylabel("Expected Return (μ)")

ax.spines['left'].set_position('zero')

ax.spines['bottom'].set_position('zero')

ax.spines['right'].set_color('none')

ax.spines['top'].set_color('none')

ax.xaxis.set_ticks_position('bottom')

ax.yaxis.set_ticks_position('left')

plt.show()

else:

if var2 == 0:

var_rf = var2

var2 += 0.0000000000001

else:

var_rf = var2

sd1sd2 = np.sqrt(var1)/np.sqrt(var2)

print("STD1/STD2 = %s" %round(sd1sd2,4))

f = plt.figure(figsize = (10,10))

ax = f.add_subplot(1, 1, 1)

color_idx = 0

colorlabel = {}

for situation in corr12:

cov12 = situation*np.sqrt(var1)*np.sqrt(var2)

s0 = (var2-cov12)/(var1+var2-2*cov12)

mu0 = (mu1*var2+mu2*var1-(mu1+mu2)*cov12)/(var1+var2-2*cov12)

var0 = (var1*var2-cov12**2)/(var1+var2-2*cov12)

if var_rf == 0:

print("[Special situation]: one risky, another risk free")

else:

print("[Situation %s] MVP: (%s, %s), covariance = %s;" %(color_idx+1, round(np.sqrt(np.abs(var0)),4), round(mu0,4), round(cov12,4)))

print("MVP strategy (weight): %s asset 1 (%s%%), and %s asset 2 (%s%%)"

%(strategy_idfier(round(s0,4)),round(100*s0,2),strategy_idfier(round(1-s0,4)),round(100*(1-s0),2)))

x = np.linspace(0, max((np.sqrt(var1),np.sqrt(var2)))*(5/3), 400)

y = np.linspace(min(mu1,mu2,mu0)-np.abs(2/3)*max(mu1,mu2,mu0), max(mu1,mu2,mu0)+np.abs((2/3)*max(mu1,mu2,mu0)), 400)

x, y = np.meshgrid(x, y)

two_assets = [[np.sqrt(var1), np.sqrt(var2)], [mu1, mu2]]

plt.scatter(*two_assets, marker='v', color='red')

formula = ((y-mu0)**2-(x**2-var0)*(((mu1-mu2)**2)/(var1+var2-2*cov12)))

masked_long = (y<min(mu1,mu2))|(max(mu1,mu2)<y)

masked_short = (y>=min(mu1,mu2))&(y<=max(mu1,mu2))

color = list(mcolors.TABLEAU_COLORS.values())

plt.contour(np.ma.masked_where(masked_long,x),np.ma.masked_where(masked_long,y),np.ma.masked_where(masked_long,formula), [0], colors=color[color_idx], linestyles='-')

plt.contour(np.ma.masked_where(masked_short,x),np.ma.masked_where(masked_short,y),np.ma.masked_where(masked_short,formula), [0], colors=color[color_idx], linestyles='--')

colorlabel["Situation %s" %(color_idx+1)] = color[color_idx]

color_idx += 1

plt.hlines(mu0,0,np.sqrt(np.abs(var0)),color='grey',lw=1,ls='--')

plt.vlines(np.sqrt(np.abs(var0)),0,mu0,color='grey',lw=1,ls='--')

min_var = [[np.sqrt(np.abs(var0))], [mu0]]

plt.scatter(*min_var, marker='x', color='purple')

text1 = plt.text(np.sqrt(var1), mu1, "(σ1, μ1)")

text2 = plt.text(np.sqrt(var2), mu2, "(σ2, μ2)")

adjust_text([text1,text2])

fake_handles = [mpatches.Patch(color=item) for item in colorlabel.values()]

plt.legend(fake_handles, colorlabel.keys(), loc='upper left', prop={'size': 10})

plt.xlabel("Standard Deviation (σ)")

plt.ylabel("Expected Return (μ)")

ax.spines['left'].set_position('zero')

ax.spines['bottom'].set_position('zero')

ax.spines['right'].set_color('none')

ax.spines['top'].set_color('none')

ax.xaxis.set_ticks_position('bottom')

ax.yaxis.set_ticks_position('left')

plt.show()

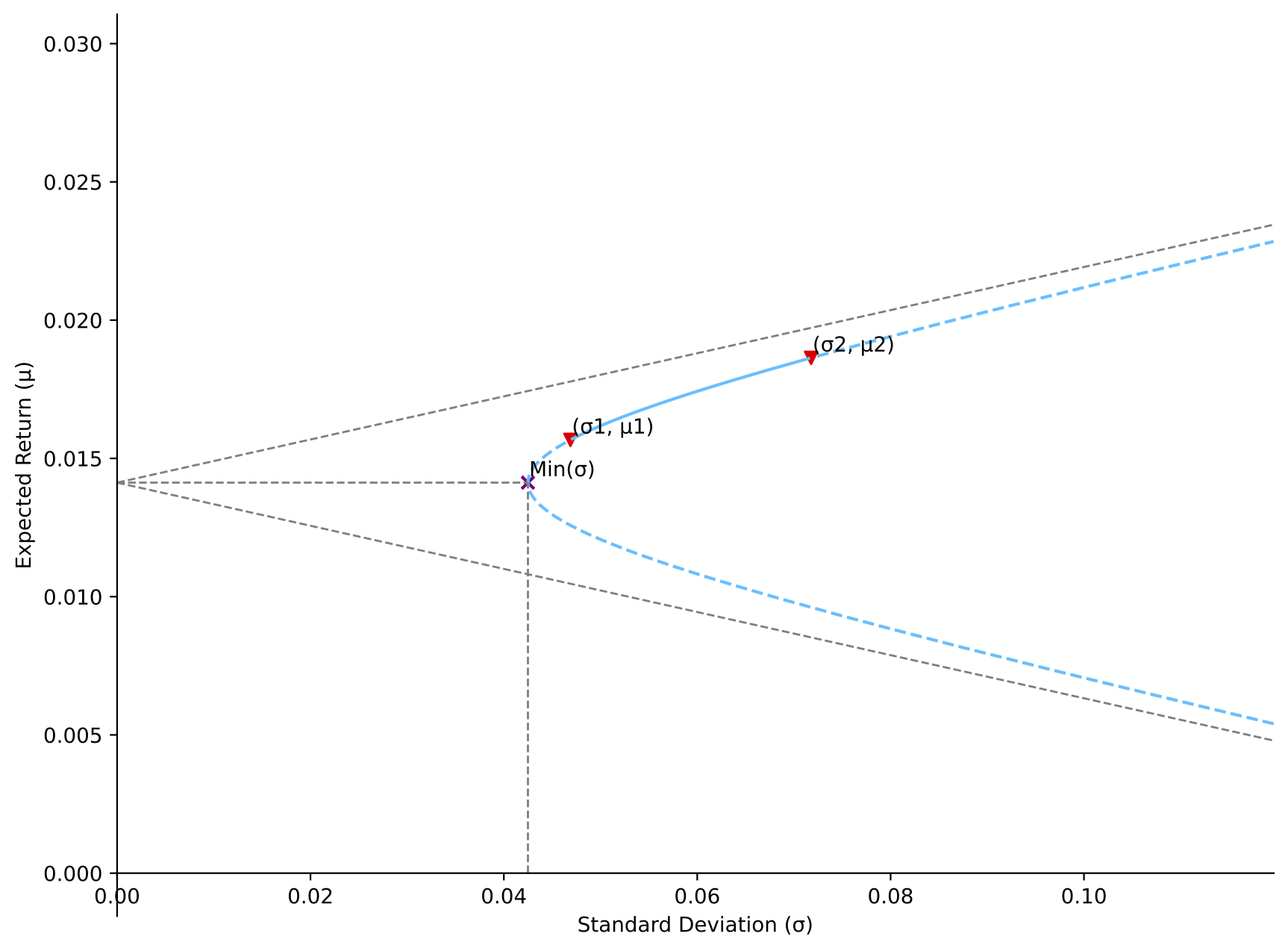

Simulation with predefined returns and variances

First, we can manually simulate the expected return and the variance of two assets, and the correlation between two assets, and see what the plot will be.

Variables are:

mu1andmu2: $\mu_{1}$ and $\mu_{2}$, the expected return of asset 1 and 2.var1andvar2: $\sigma_{1}$ and $\sigma_{2}$, the variance of asset 1 and 2 ($\sigma_1 \neq \sigma_2$).corr12: $\rho_{12}$, the correlation between asset 1 and 2. $\rho_{12}=\frac{c_{12}}{\sigma_1\sigma_2}, \rho_{12} \in [-1,1]$

mu1 = 0.02

mu2 = 0.03

var1 = 0.015

var2 = 0.03

# corr12 = np.sqrt(var1)/np.sqrt(var2)

corr12 = random.uniform(-1,1)

two_asset_plot(mu1, mu2, var1, var2, corr12)

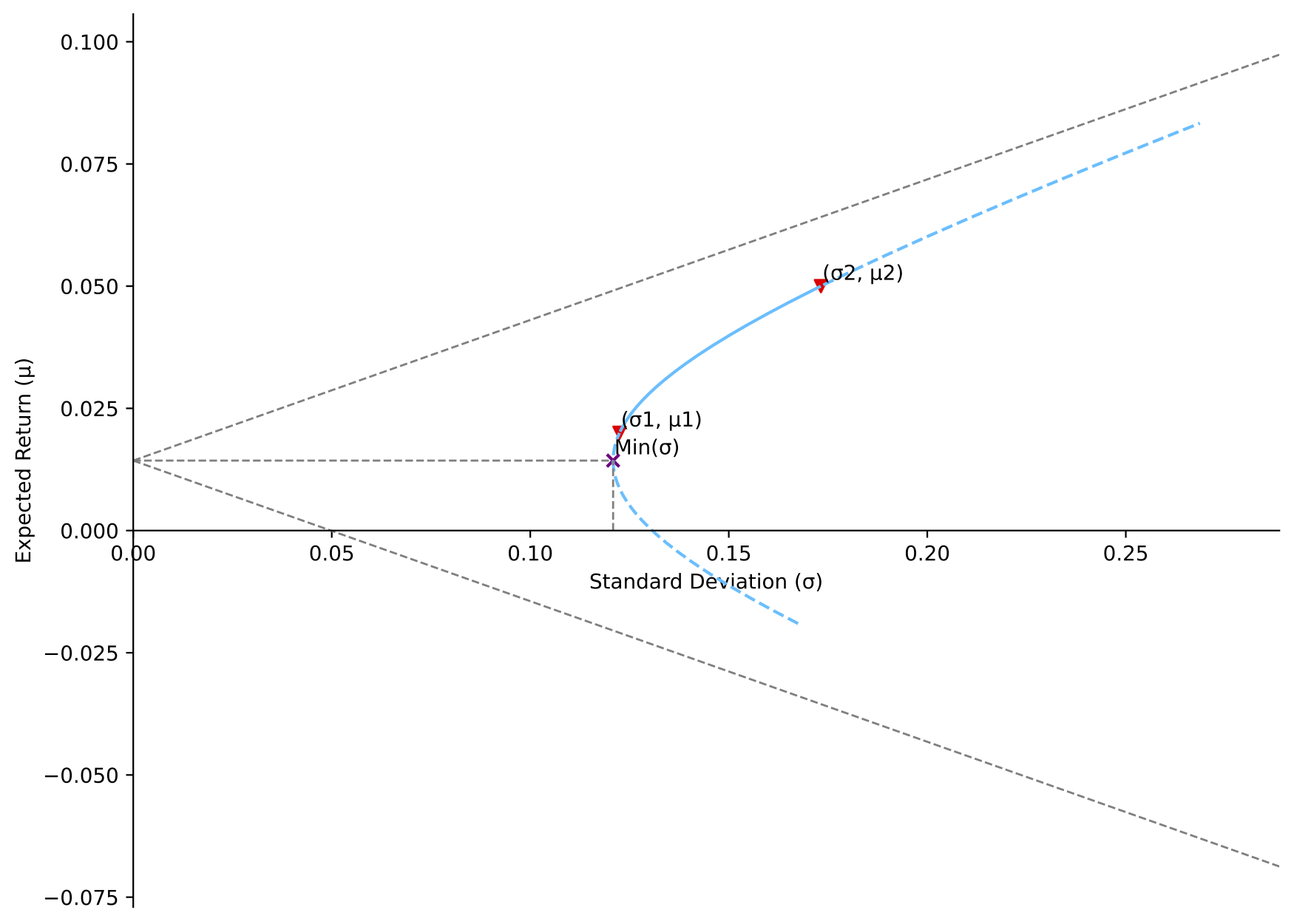

[Situation 2]: correlation between STD1/STD2 (0.7071) and 1

MVP strategy (weight): long asset 1 (129.14%), and short asset 2 (-29.14%)

Return of MVP: 0.0171

Minimum variance: 0.0142

Covariance: 0.0178

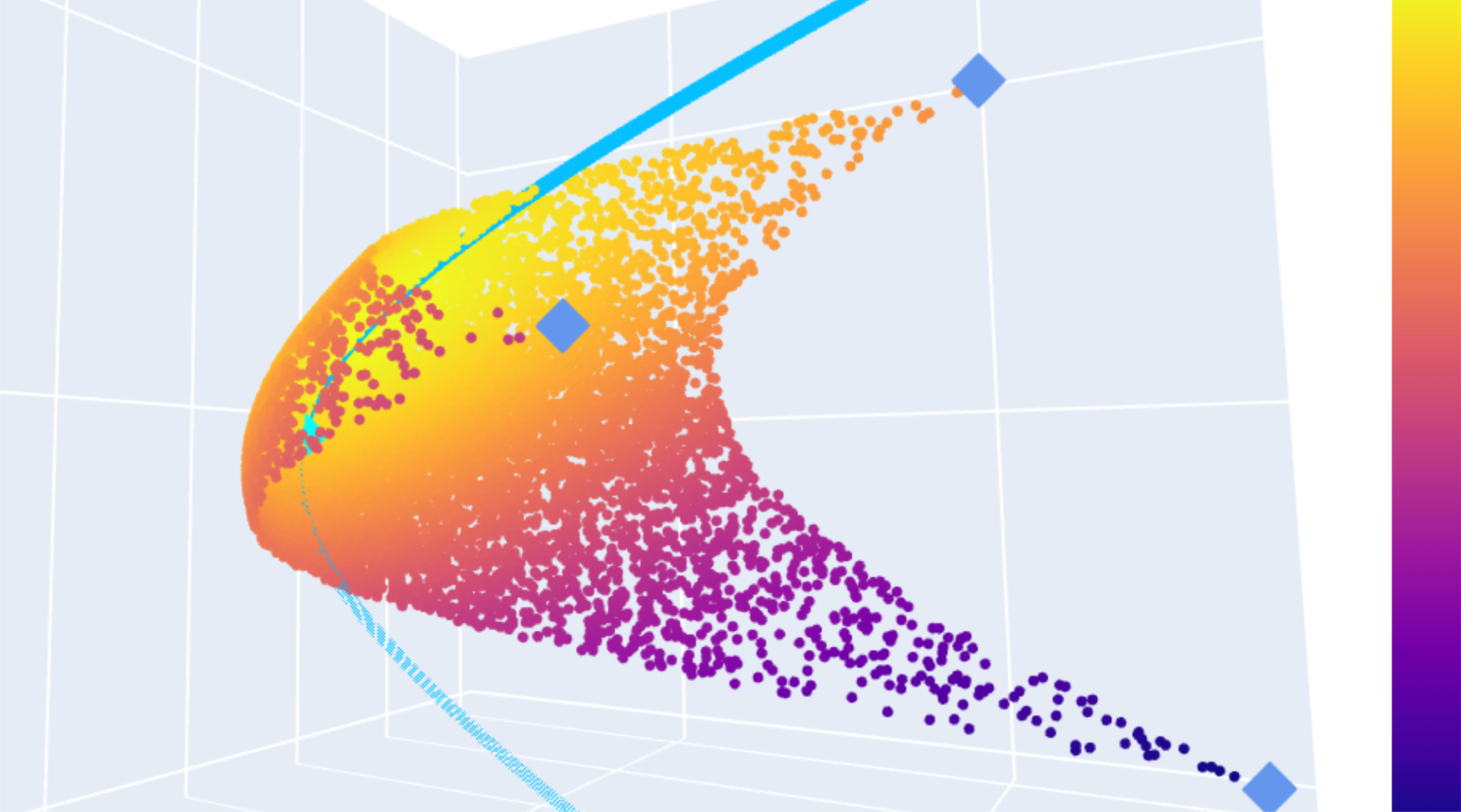

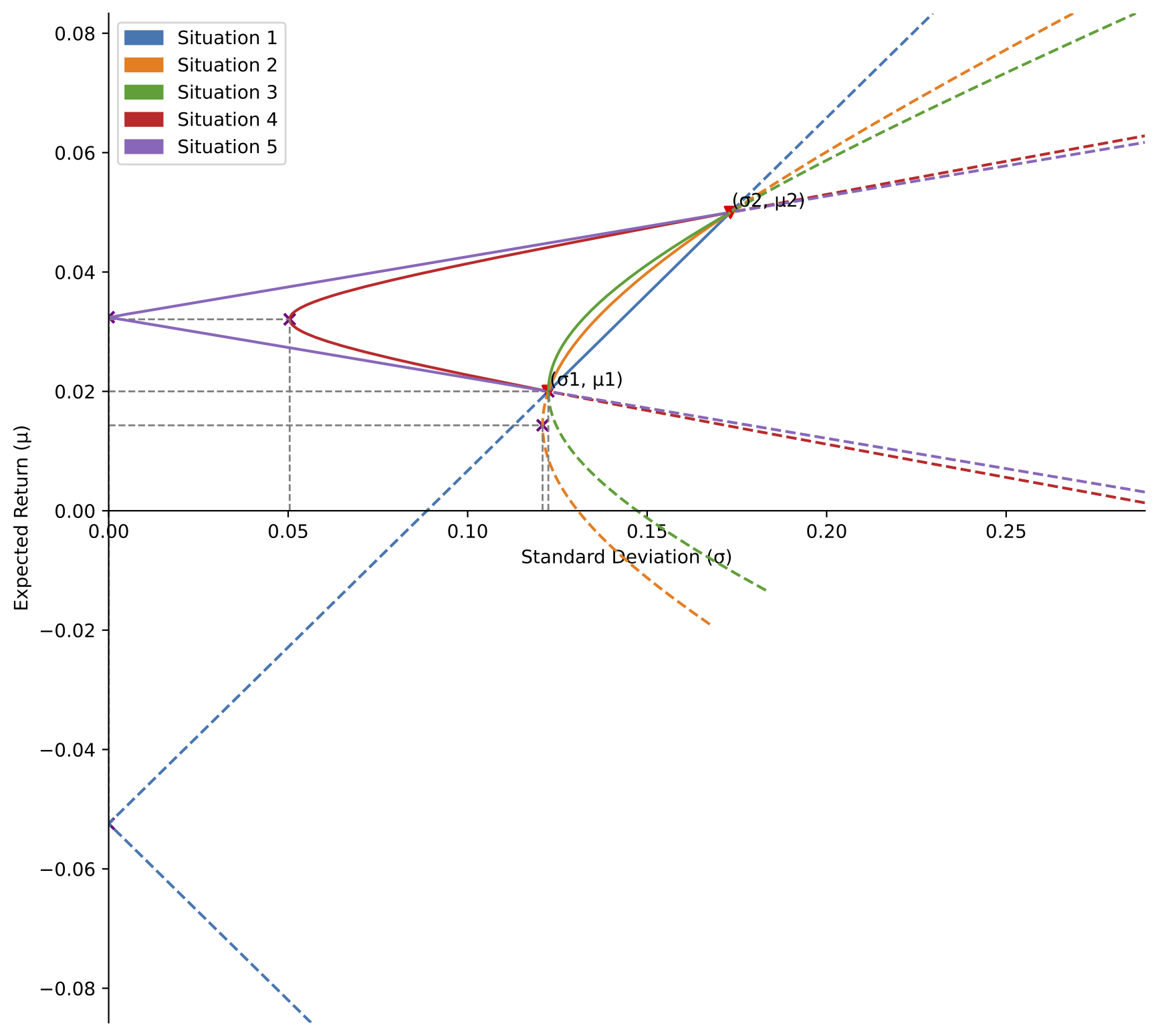

Assume $\sigma_1 \leq \sigma_2$, the plausible situations are:

If $\rho = 1$, there is a feasible set with short selling such that $\sigma_V=0$.

If $\frac{\sigma_1}{\sigma_2}<\rho<1$, the feasible set includes a short position, and $\sigma_V<\sigma_1$. But for every set without short selling, $\sigma_V\geq \sigma_1$.

If $\rho = \frac{\sigma_1}{\sigma_2}$, for every attainable set, $\sigma_V \geq \sigma_1$.

If $-1<\rho<\frac{\sigma_1}{\sigma_2}$, the feasible set without short selling has $\sigma_V<\sigma_1$.

If $\rho = -1$, a feasible set without short selling has $\sigma_V=0$.

# Separate plots for the five situations above

mu1 = 0.02

mu2 = 0.05

var1 = 0.015

var2 = 0.03

corr12 = [1, random.uniform(np.sqrt(var1)/np.sqrt(var2), 1), np.sqrt(var1)/np.sqrt(var2),

random.uniform(-1, np.sqrt(var1)/np.sqrt(var2)), -1]

if var1>0 and var2>0 and var1 != var2:

for situation in map(lambda x: two_asset_plot(mu1, mu2, var1, var2, x), corr12):

situation

else:

print("Error: reset variance")

[Situation 1]: correlation equals 1

MVP strategy (weight): long asset 1 (341.42%), and short asset 2 (-241.42%)

Return of MVP: -0.0524

Minimum variance: 0.0

Covariance: 0.0212

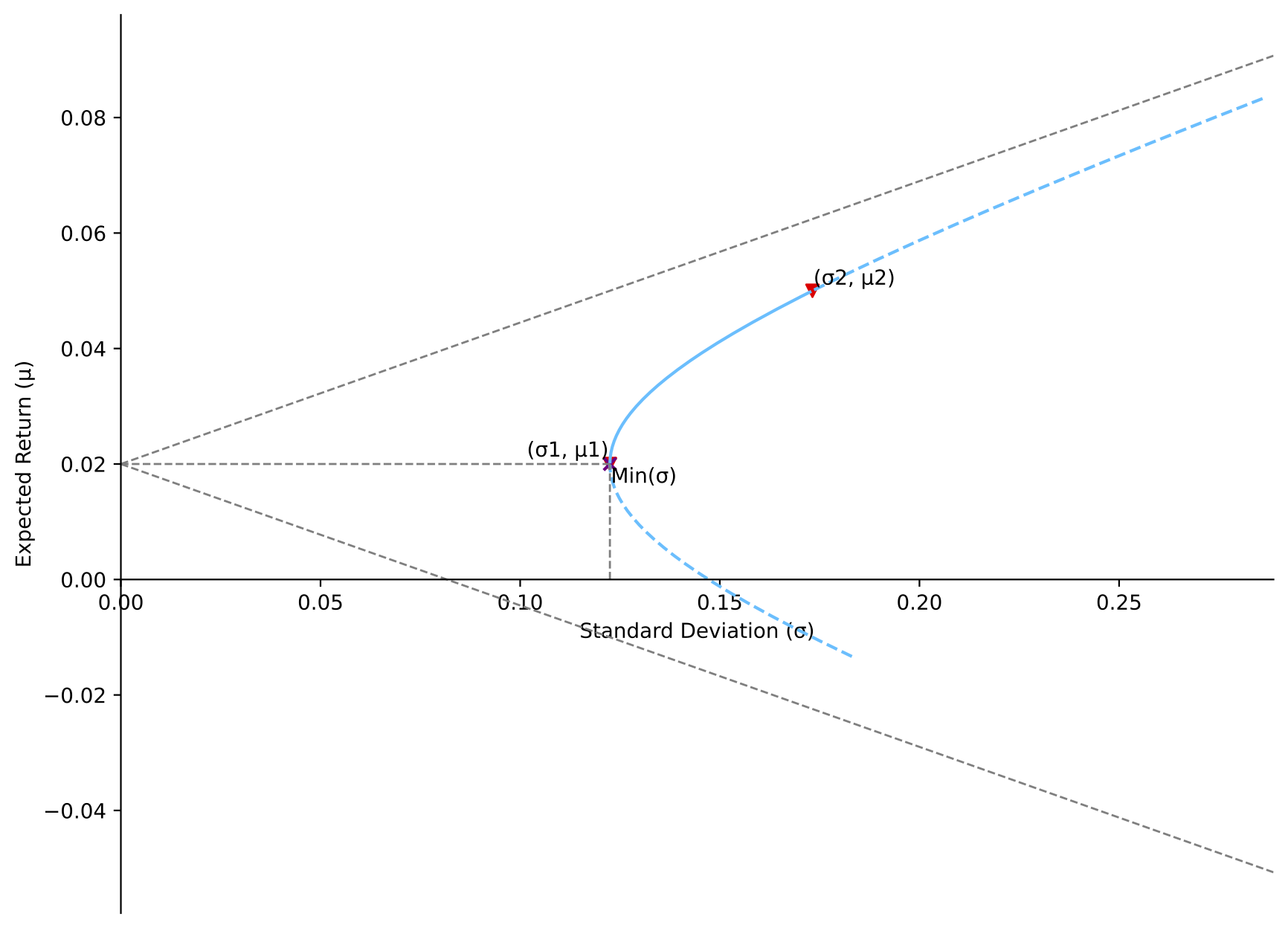

[Situation 2]: correlation between STD1/STD2 (0.7071) and 1

MVP strategy (weight): long asset 1 (118.95%), and short asset 2 (-18.95%)

Return of MVP: 0.0143

Minimum variance: 0.0146

Covariance: 0.0171

[Situation 3]: correlation equals STD1/STD2 (0.7071)

MVP strategy (weight): long asset 1 (100.0%), and ignore asset 2 (0.0%)

Return of MVP: 0.02

Minimum variance: 0.015

Covariance: 0.015

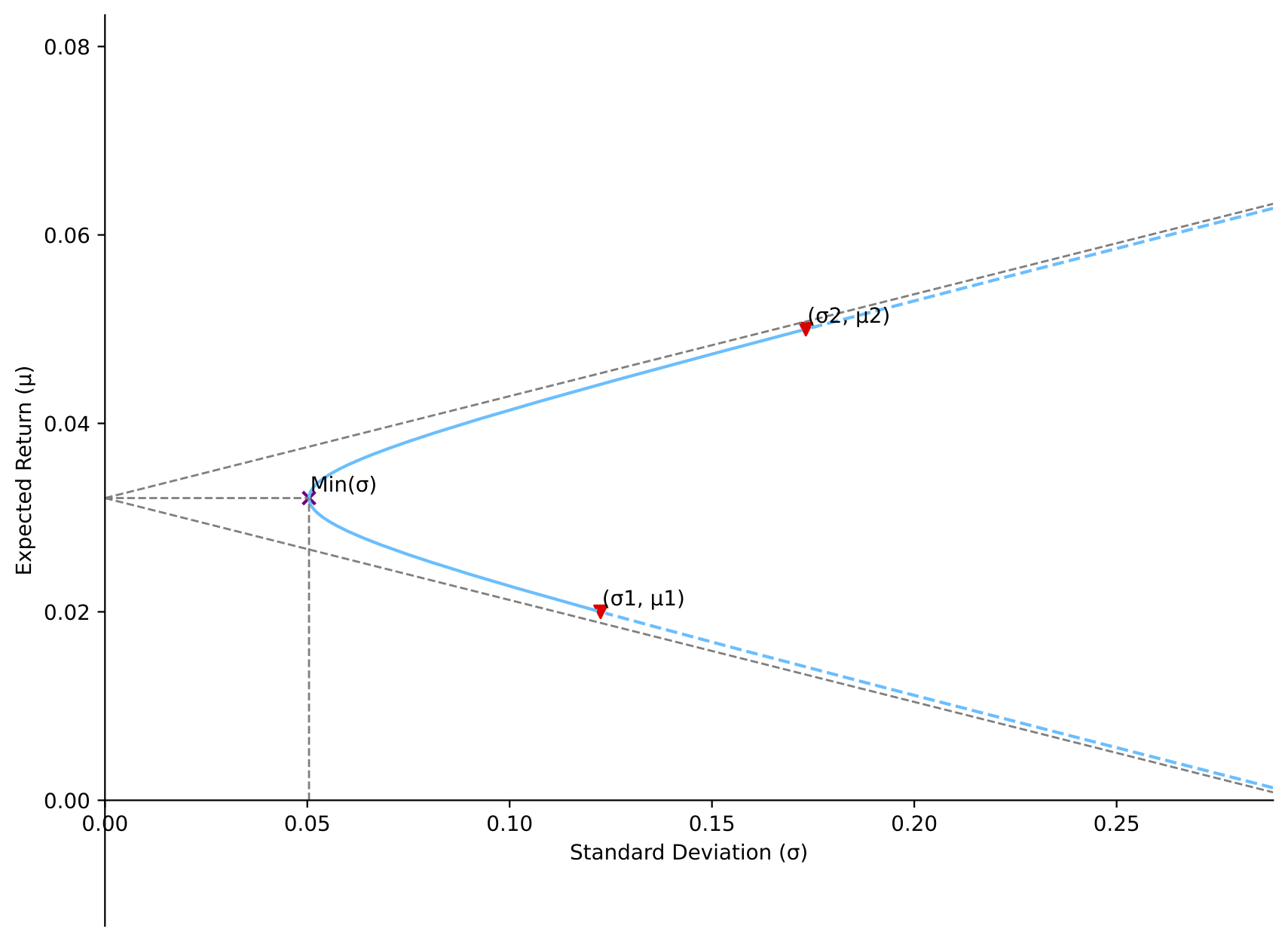

[Situation 4]: correlation between -1 and STD1/STD2 (0.7071)

MVP strategy (weight): long asset 1 (59.75%), and long asset 2 (40.25%)

Return of MVP: 0.0321

Minimum variance: 0.0025

Covariance: -0.016

[Situation 5]: correlation equals -1

MVP strategy (weight): long asset 1 (58.58%), and long asset 2 (41.42%)

Return of MVP: 0.0324

Minimum variance: 0.0

Covariance: -0.0212

## Aggregated plot for the five situations

# corr12 = [1, random.uniform(np.sqrt(var1)/np.sqrt(var2), 1), np.sqrt(var1)/np.sqrt(var2),

# random.uniform(-1, np.sqrt(var1)/np.sqrt(var2)), -1]

two_asset_plot(mu1, mu2, var1, var2, corr12, separate_plot=False)

STD1/STD2 = 0.7071

[Situation 1] MVP: (0.0, -0.0524), covariance = 0.0212;

MVP strategy (weight): long asset 1 (341.42%), and short asset 2 (-241.42%)

[Situation 2] MVP: (0.1209, 0.0143), covariance = 0.0171;

MVP strategy (weight): long asset 1 (118.95%), and short asset 2 (-18.95%)

[Situation 3] MVP: (0.1225, 0.02), covariance = 0.015;

MVP strategy (weight): long asset 1 (100.0%), and ignore asset 2 (0.0%)

[Situation 4] MVP: (0.0504, 0.0321), covariance = -0.016;

MVP strategy (weight): long asset 1 (59.75%), and long asset 2 (40.25%)

[Situation 5] MVP: (0.0, 0.0324), covariance = -0.0212;

MVP strategy (weight): long asset 1 (58.58%), and long asset 2 (41.42%)

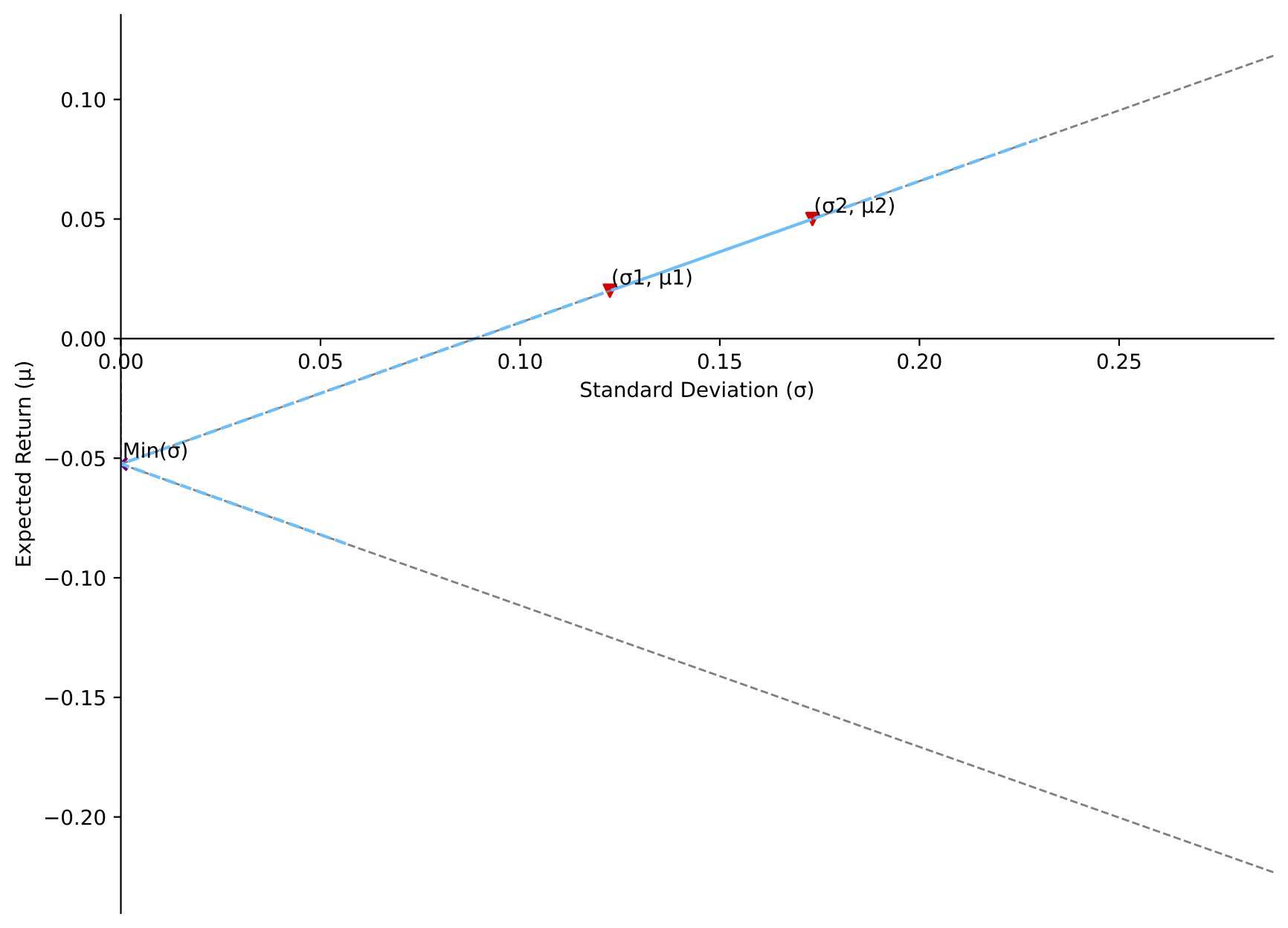

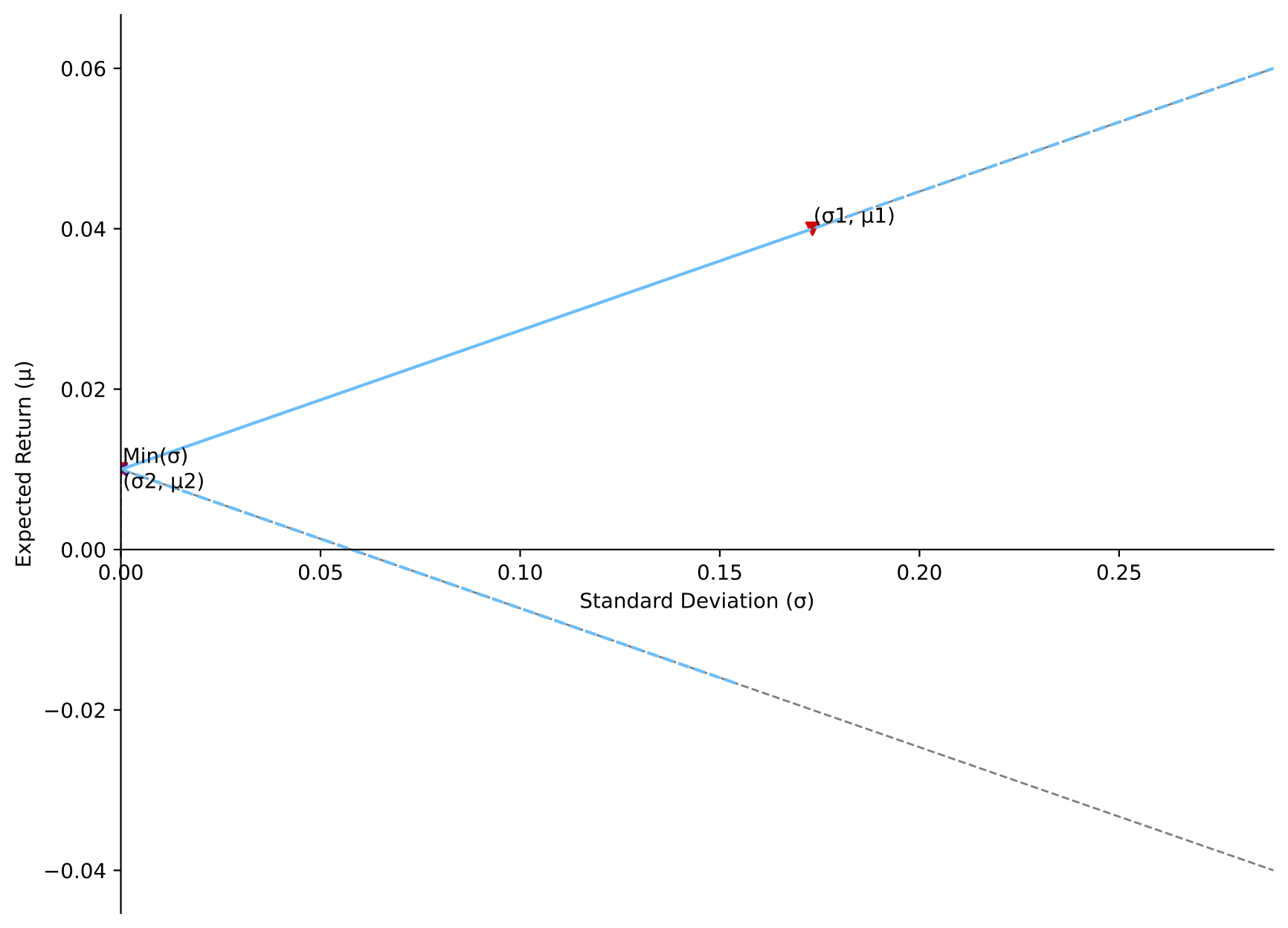

If the portfolio is constructed by one risky asset (expected return: $\mu_1$, variance: $\sigma_1 > 0$) and one risk-free asset (expected return: $R$, variance: 0), the variance of the portfolio would be:

\[\begin{equation} \sigma_V = |w_1| \sigma_1 \end{equation}\]# Special situation: when asset 2 is risk free

mu1_rrf = 0.04

mu2_rrf = 0.01

var1_rrf = 0.03

var2_rrf = 0

corr12_rrf = 0

two_asset_plot(mu1_rrf, mu2_rrf, var1_rrf, var2_rrf, corr12_rrf)

[Special situation]: one risky, another risk free

MVP strategy (weight): ignore asset 1 (0.0%), and long asset 2 (100.0%)

Return of MVP: 0.01

Minimum variance: 0.0

Covariance: 0.0

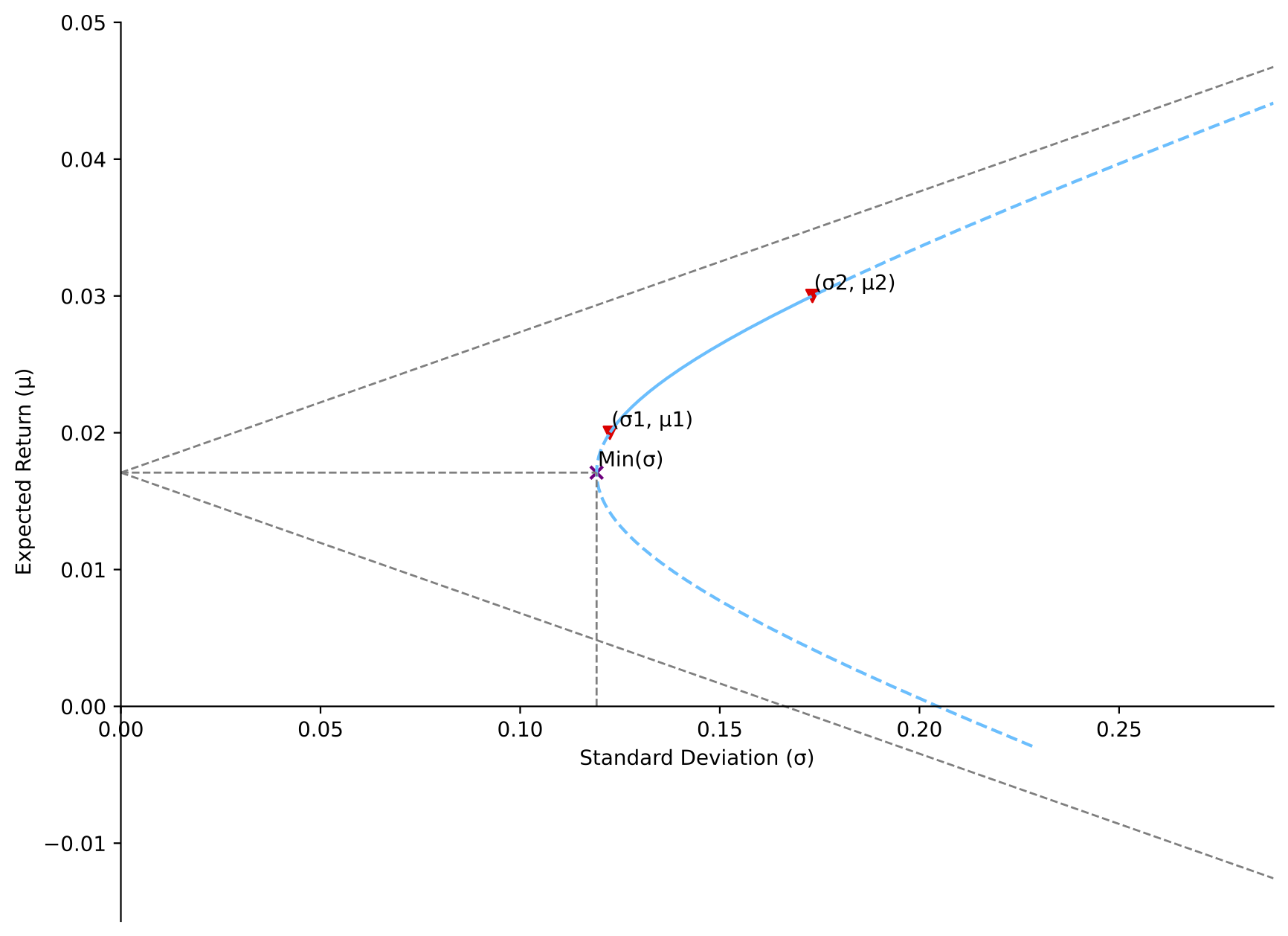

Example with financial data

For convenience, below provides an example using the monthly value-weighted returns of the portfolio sorted on variance decile, from the Fama/French Data Library.

See pandas-datareader for a wider range of data choices using DataReader.

df = pdr.DataReader('Portfolios_Formed_on_VAR', 'famafrench')

df_vwr = df[0].progress_apply(lambda x: x*0.01)

df_vwr.head(10)

| Lo 20 | Qnt 2 | Qnt 3 | Qnt 4 | Hi 20 | Lo 10 | Dec 2 | Dec 3 | Dec 4 | Dec 5 | Dec 6 | Dec 7 | Dec 8 | Dec 9 | Hi 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||||

| 2017-04 | 0.0169 | 0.0033 | 0.0050 | 0.0087 | -0.0028 | 0.0192 | 0.0135 | 0.0030 | 0.0040 | 0.0074 | 0.0016 | 0.0081 | 0.0097 | 0.0069 | -0.0150 |

| 2017-05 | 0.0241 | -0.0045 | -0.0107 | -0.0037 | -0.0142 | 0.0253 | 0.0214 | -0.0021 | -0.0069 | -0.0198 | -0.0002 | -0.0224 | 0.0183 | -0.0056 | -0.0269 |

| 2017-06 | -0.0047 | 0.0270 | 0.0252 | 0.0226 | 0.0346 | 0.0003 | -0.0109 | 0.0302 | 0.0183 | 0.0259 | 0.0239 | 0.0117 | 0.0344 | 0.0221 | 0.0579 |

| 2017-07 | 0.0203 | 0.0181 | 0.0241 | 0.0095 | 0.0273 | 0.0141 | 0.0276 | 0.0162 | 0.0225 | 0.0235 | 0.0249 | 0.0116 | 0.0074 | 0.0331 | 0.0200 |

| 2017-08 | 0.0079 | 0.0061 | -0.0074 | -0.0185 | -0.0084 | 0.0104 | 0.0049 | 0.0125 | -0.0084 | -0.0093 | -0.0047 | -0.0277 | -0.0083 | -0.0241 | 0.0115 |

| 2017-09 | 0.0217 | 0.0188 | 0.0362 | 0.0526 | 0.0444 | 0.0092 | 0.0374 | 0.0261 | 0.0085 | 0.0328 | 0.0426 | 0.0517 | 0.0536 | 0.0311 | 0.0731 |

| 2017-10 | 0.0304 | 0.0257 | 0.0062 | 0.0214 | -0.0219 | 0.0310 | 0.0293 | 0.0322 | 0.0164 | 0.0017 | 0.0161 | 0.0166 | 0.0270 | -0.0208 | -0.0237 |

| 2017-11 | 0.0340 | 0.0287 | 0.0358 | 0.0313 | 0.0322 | 0.0345 | 0.0335 | 0.0320 | 0.0247 | 0.0584 | 0.0164 | 0.0247 | 0.0356 | 0.0238 | 0.0485 |

| 2017-12 | 0.0120 | 0.0095 | 0.0197 | 0.0002 | 0.0235 | 0.0053 | 0.0193 | 0.0103 | 0.0084 | 0.0205 | 0.0190 | -0.0004 | 0.0016 | 0.0191 | 0.0299 |

| 2018-01 | 0.0483 | 0.0560 | 0.0554 | 0.1001 | 0.0414 | 0.0282 | 0.0691 | 0.0567 | 0.0542 | 0.0633 | 0.0461 | 0.1221 | 0.0515 | 0.0397 | 0.0440 |

def two_asset_series_plot(df, first_col, second_col):

mu1 = df.mean().loc[first_col]

mu2 = df.mean().loc[second_col]

var1 = (df.std().loc[first_col])**2

var2 = (df.std().loc[second_col])**2

corr12 = df[first_col].corr(df[second_col], method='pearson', min_periods=None)

return two_asset_plot(mu1, mu2, var1, var2, corr12)

# choose any two of the portfolios on variance decile

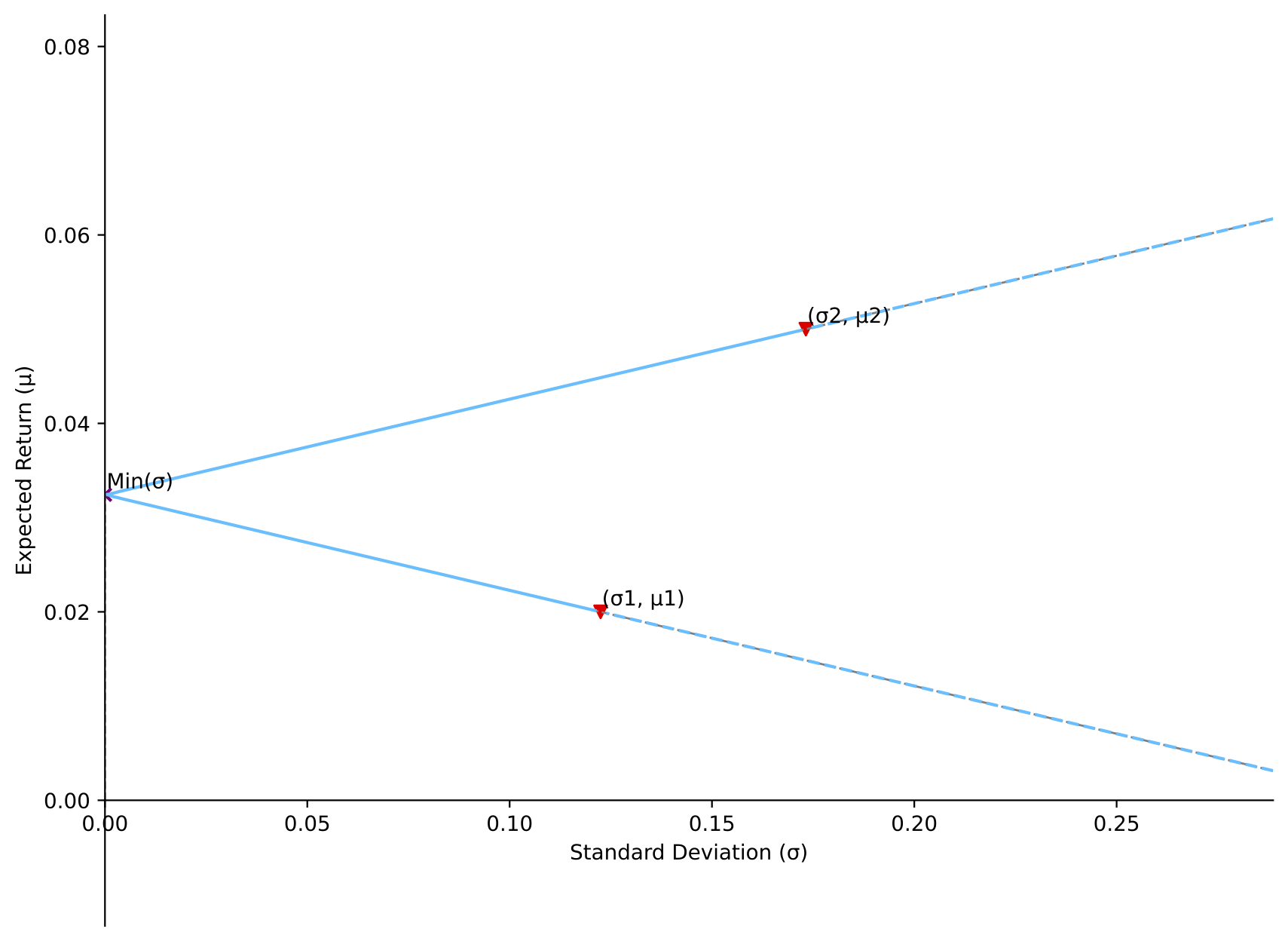

two_asset_series_plot(df_vwr, "Dec 2", "Dec 7")

[Situation 2]: correlation between STD1/STD2 (0.6532) and 1

MVP strategy (weight): long asset 1 (152.11%), and short asset 2 (-52.11%)

Return of MVP: 0.0141

Minimum variance: 0.0018

Covariance: 0.003